Introduction

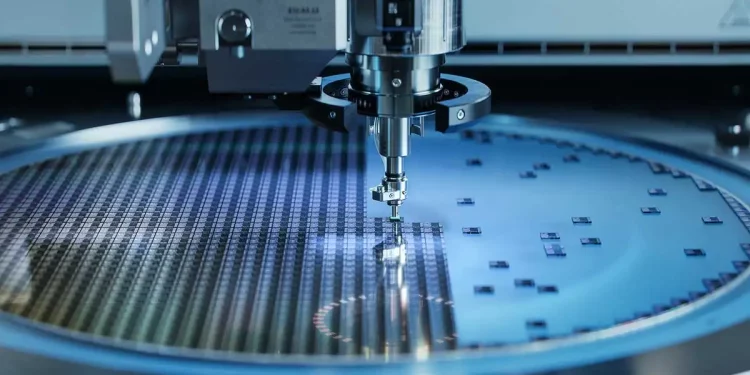

South Korea’s economy has long been defined by its technological prowess and innovative industries. Among the many sectors that have shaped the country’s financial markets, the semiconductor industry stands out as a major player. With semiconductor companies dominating the KOSPI (Korea Composite Stock Price Index), South Korea has become a global leader in chip production, benefiting from both domestic innovation and booming international demand. As the global economy becomes increasingly dependent on semiconductors, South Korean markets are seeing significant growth driven by this vital sector. However, this dominance comes with its own set of challenges, including risks from supply chain disruptions and global competition. In this article, we explore the role of the semiconductor industry in South Korea’s economy, investment opportunities in related sectors, and the potential risks associated with the ongoing semiconductor boom.

1. The Dominance of Semiconductor Companies in the KOSPI Index

The KOSPI index, which is the benchmark stock market index of the Korea Stock Exchange, is heavily influenced by the performance of large, high-profile companies. Among these, semiconductor giants like Samsung Electronics, SK Hynix, and LG Electronics have a commanding presence. Together, these companies represent a significant portion of the KOSPI’s overall market capitalization, making the semiconductor sector a key driver of the index’s performance.

- Samsung Electronics: As one of the world’s largest and most influential technology companies, Samsung Electronics has been the cornerstone of South Korea’s semiconductor industry. The company is a global leader in the production of memory chips, including DRAM and NAND flash memory, as well as semiconductor manufacturing for other tech companies. Samsung’s dominance in the semiconductor sector gives it a substantial impact on both South Korean and global markets.

- SK Hynix: Another semiconductor powerhouse, SK Hynix specializes in memory chips and is a direct competitor to Samsung in the global semiconductor market. The company is one of the largest producers of DRAM and NAND flash memory, making it a key player in the global chip supply chain. SK Hynix has also been increasing its investments in advanced technologies like 3D NAND flash and DRAM, positioning itself for future growth.

- LG Electronics: While LG is more diversified in its business portfolio, the company also plays a significant role in the semiconductor space, particularly in display technology and other related components. Although not as dominant in the semiconductor market as Samsung or SK Hynix, LG is still a noteworthy contributor to South Korea’s semiconductor industry.

Together, these companies dominate the KOSPI index and their performance is closely tied to global semiconductor demand. The KOSPI’s strong correlation with the semiconductor sector means that fluctuations in chip demand and pricing can have a substantial impact on the broader South Korean market.

2. Global Demand for Chips and Its Impact on South Korean Markets

Semiconductors are the backbone of modern electronics, powering everything from smartphones and computers to cars, industrial machinery, and even household appliances. With the rapid growth of technologies like artificial intelligence (AI), the Internet of Things (IoT), 5G networks, and electric vehicles (EVs), the global demand for semiconductors has skyrocketed. South Korea, with its leading semiconductor manufacturers, has become a central player in meeting this demand.

- Surging Demand for Chips: The COVID-19 pandemic accelerated the need for semiconductors as more people turned to remote work and digital services, increasing the demand for personal devices, data centers, and cloud computing services. Meanwhile, the automotive industry, which had initially cut back on chip orders, is now recovering and increasingly relying on chips for the growing number of electronics in vehicles.

- Impact on South Korea’s Economy: The surge in semiconductor demand has had a direct and positive impact on South Korea’s economy. In 2021, semiconductor exports accounted for a significant portion of the country’s total exports, helping to boost South Korea’s GDP growth. Given that the semiconductor sector represents a large share of the country’s exports, South Korea’s financial markets are highly sensitive to changes in global chip demand. As the global economy continues to digitize and innovate, South Korean semiconductor companies are well-positioned to benefit from the ongoing surge in demand.

- Stock Market Performance: South Korea’s stock market has shown a strong correlation with the performance of semiconductor companies. When semiconductor stocks perform well, the KOSPI index tends to rise, reflecting the growth in the broader market. Investors often look to the semiconductor sector as a barometer of the health of South Korea’s financial markets and economy.

3. Investment Opportunities in Tech and Associated Sectors

As semiconductor companies continue to drive South Korea’s economic growth, a number of related sectors are also poised for growth. Investors looking to capitalize on the semiconductor boom may want to explore opportunities in the following sectors:

- Technology Hardware and Equipment: Companies that manufacture the equipment used in semiconductor production are key beneficiaries of the semiconductor boom. These companies supply tools for designing, testing, and packaging semiconductors. Investing in these equipment manufacturers can provide exposure to the broader semiconductor value chain.

- Electric Vehicles (EVs) and Battery Manufacturers: As the demand for EVs rises, so too does the need for chips that control electric motors, battery management systems, and infotainment. South Korean firms like LG Chem and SK Innovation are leading players in the EV battery space and are expected to benefit from the growing demand for semiconductors in the automotive sector.

- AI and Cloud Computing: With the global shift toward AI, machine learning, and cloud computing, companies that provide services and infrastructure for these technologies are also in demand for high-performance chips. Firms specializing in AI, big data, and cloud services in South Korea stand to benefit from the continued growth in semiconductor demand.

- Renewable Energy: The rise of smart grids and clean energy technologies is driving the need for advanced semiconductors. South Korea’s growing focus on renewable energy makes semiconductor companies involved in this sector attractive for long-term growth. Energy-efficient chips used in solar inverters, wind turbines, and other renewable energy technologies are likely to be in demand.

- Internet of Things (IoT): With billions of connected devices expected to be deployed in the coming years, the IoT market represents a significant opportunity for semiconductor manufacturers. From wearables to smart homes, IoT applications require a range of specialized chips, providing additional investment opportunities in South Korea’s tech landscape.

4. Potential Risks from Global Supply Chain Disruptions

While the semiconductor boom is generally seen as a positive trend for South Korea, there are potential risks that investors need to consider. Global supply chain disruptions, particularly those caused by geopolitical tensions, natural disasters, or pandemics, can have significant consequences for the semiconductor industry.

- Supply Chain Vulnerabilities: The semiconductor supply chain is highly complex and dependent on a variety of raw materials, including rare earth metals, which are often sourced from politically unstable regions. Any disruption in the supply of these materials can affect chip production. Additionally, the semiconductor manufacturing process is incredibly capital-intensive, and delays or disruptions at any stage of production can lead to significant financial losses.

- Geopolitical Tensions: Increasing tensions between the U.S. and China have already disrupted the global semiconductor supply chain. The U.S. has imposed sanctions on Chinese tech companies, limiting their access to critical semiconductor components. Similarly, trade disputes between Japan and South Korea have historically affected the semiconductor industry. Given the global nature of semiconductor production, geopolitical risks remain a significant concern for investors.

- Competition from Other Countries: While South Korea remains a dominant force in semiconductor production, other countries, notably China and Taiwan, are ramping up their efforts to capture a larger share of the global semiconductor market. Increased competition could affect South Korea’s market share and growth prospects, especially if countries like China continue to invest heavily in semiconductor technology and production capabilities.

- Environmental Risks: The semiconductor manufacturing process is energy-intensive and relies heavily on water resources. South Korea’s semiconductor companies must adapt to growing environmental concerns, including the need for sustainable production methods and the potential regulatory pressures associated with environmental sustainability. Any failure to adapt to these challenges could result in reputational damage and regulatory setbacks.

Conclusion

South Korea’s semiconductor industry is a key pillar of its economy and plays a central role in the country’s financial markets. The rising global demand for semiconductors presents significant opportunities for South Korean companies and investors. However, investors must be mindful of the risks associated with supply chain disruptions, geopolitical tensions, and competition from other global players. By focusing on the broader tech ecosystem, including AI, EVs, renewable energy, and IoT, investors can position themselves to capitalize on the ongoing semiconductor boom while navigating potential market risks.