Introduction

Political changes across the globe—whether through shifts in leadership, policy reforms, or major geopolitical events—often have profound, far-reaching effects on the global economy. From influencing trade relations to altering investor sentiment and market structures, political dynamics play a pivotal role in shaping economic trajectories. These political changes can impact everything from local job markets to international capital flows, often triggering cascading effects in markets and industries worldwide. While the immediate effects of political events are often clear, the long-term economic consequences are more complex and require careful analysis. This article will explore the long-term effects of political changes worldwide on the global economy, focusing on the key areas of trade, investment, regulatory environments, and geopolitical stability.

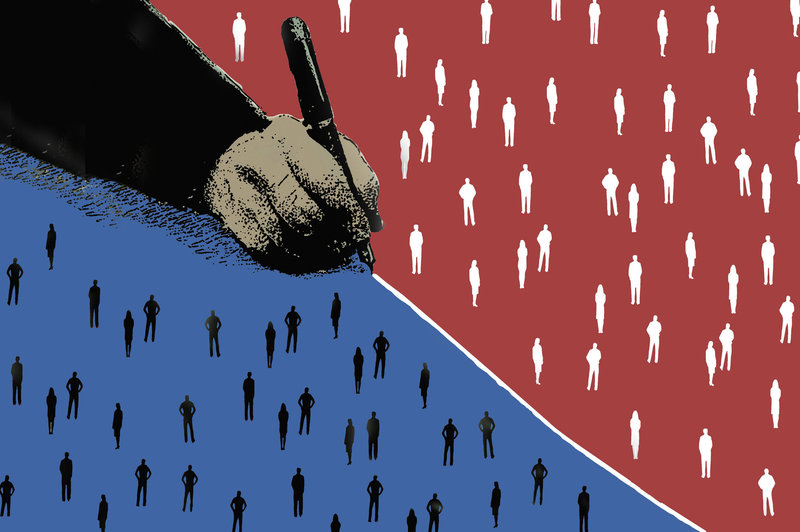

Section 1: Trade Relations and Global Supply Chains

One of the most direct and visible impacts of political changes on the global economy is the disruption or transformation of trade relations and supply chains. Changes in government policies or leadership often lead to new trade agreements, the imposition or lifting of tariffs, or the enactment of regulations that can dramatically reshape international commerce.

Long-Term Effects on Global Trade:

- Shift in Trade Alliances and Agreements: Political shifts, such as new leadership or changes in government, often result in the renegotiation of trade deals. For instance, the U.S. withdrawal from the Trans-Pacific Partnership (TPP) under the Trump administration and the renegotiation of NAFTA into the United States-Mexico-Canada Agreement (USMCA) changed trade dynamics across North America. Over the long term, such decisions can reshape supply chains, forcing businesses to adjust to new tariffs, customs regulations, or market access conditions. Long-Term Economic Impact: A shift away from free trade agreements or trade liberalization policies often increases the cost of goods and services, leading to inefficiencies in global supply chains. In the long run, this can lead to less global competition, higher consumer prices, and reduced economic growth. On the flip side, trade agreements that reduce tariffs and improve market access can stimulate growth in export-driven industries, particularly in developing nations.

- Trade Wars and Protectionism: Political instability or a rise in populism can result in protectionist policies, such as tariffs, trade barriers, or embargoes, as governments seek to protect domestic industries. The U.S.-China trade war, which escalated in 2018, is a key example of how political tensions can disrupt trade flows. Long-Term Economic Impact: Trade wars can lead to long-term disruptions in global supply chains, resulting in inefficiencies and higher costs for businesses and consumers. The reorientation of global supply chains can lead to the diversification of trade routes or the reshoring of manufacturing to more politically stable regions. However, this can also result in economic fragmentation, slowing global economic integration and reducing global economic growth potential.

Impact on Global Supply Chains:

Political instability, regulatory changes, and shifts in trade policy can disrupt global supply chains, affecting manufacturing, agriculture, and resource extraction. In the long term, companies may diversify their supply sources or move production to more politically stable countries, leading to an evolution in the structure of global trade networks.

Section 2: Investment Trends and Capital Flows

Political change can significantly impact global investment trends and capital flows, as investors react to shifting political risks, new regulations, and changes in the economic outlook.

Long-Term Effects on Investment:

- Policy Shifts and Market Sentiment: Political changes often lead to shifts in fiscal and monetary policy, which can affect interest rates, tax rates, and overall economic stability. For example, changes in leadership can result in altered taxation policies or government spending priorities, which can influence corporate profitability and economic growth. Political decisions that alter a country’s economic stability can drive investors away from certain markets or encourage capital inflows to more stable regions. Long-Term Economic Impact: The long-term effects on investment depend on the policies implemented by new political leaders. A government that implements pro-business policies, such as tax cuts or deregulation, could boost investor confidence, leading to higher capital inflows and investment in infrastructure and industries. Conversely, policies perceived as unfavorable to business, such as nationalization or higher corporate taxes, may lead to capital flight and reduced foreign direct investment (FDI).

- Geopolitical Risks and Global Capital Flows: Geopolitical events, such as wars, conflicts, or political instability, can create significant uncertainty in global markets. For instance, the political instability in the Middle East, or the ongoing tensions between the U.S. and China, often causes investors to become more risk-averse, leading to capital flight from riskier markets. Long-Term Economic Impact: Persistent geopolitical risks can result in long-term shifts in global capital flows. For instance, a prolonged conflict in a key region can lead to the diversion of investments away from that region to safer havens, such as developed economies or markets with more political stability. This can hinder the economic development of emerging markets and exacerbate income inequality between countries.

Section 3: Regulatory Changes and Corporate Strategies

Political changes often bring about significant regulatory shifts, which can impact industries, labor markets, and even entire economies. Changes in environmental regulations, labor laws, or industry-specific policies can all alter the long-term trajectory of the economy.

Long-Term Effects of Regulatory Changes:

- Environmental and Climate Policies: Governments worldwide are increasingly introducing regulations related to climate change and environmental protection. The Paris Agreement, for instance, has influenced many countries to adopt stricter environmental policies. Political changes that favor the implementation of green energy initiatives can lead to long-term investments in clean technologies, renewable energy, and sustainable industries. Long-Term Economic Impact: In the long run, policies that promote environmental sustainability could drive innovation in clean energy technologies, electric vehicles, and sustainable agriculture. These shifts can create new markets, generate jobs, and reduce dependence on fossil fuels. However, strict environmental regulations may also lead to higher costs for certain industries and disrupt established supply chains, particularly in energy-intensive sectors like manufacturing and transportation.

- Labor and Employment Policies: Political decisions that affect labor laws, such as changes to minimum wage laws, workers’ rights, and immigration policies, can have significant long-term economic implications. For example, policies that promote higher wages may boost domestic consumption but could also raise the cost of production for businesses. Long-Term Economic Impact: In countries with high labor costs, businesses may choose to relocate production to regions with more favorable labor laws. Conversely, pro-labor policies may result in higher consumer spending and better economic outcomes for the lower and middle classes. Political changes that make it easier or more difficult to hire foreign labor could also affect industries such as technology, agriculture, and manufacturing.

- Tax and Fiscal Policies: Tax reforms and fiscal policy changes are key areas where political changes can have lasting economic effects. For instance, changes in corporate tax rates can affect business investment, corporate profits, and ultimately economic growth. A move toward higher taxes may discourage investment, while tax cuts can stimulate business expansion and job creation. Long-Term Economic Impact: Long-term economic growth may be driven by political policies that promote investment through tax incentives or fiscal stimulus. Conversely, policies that increase the tax burden on businesses or individuals can stifle innovation and reduce disposable income, which may ultimately slow economic growth.

Section 4: Geopolitical Stability and Economic Growth

Geopolitical stability plays a central role in fostering a favorable environment for economic growth. Political stability encourages long-term investments, fosters trade relations, and provides the certainty needed for sustainable economic development.

Long-Term Economic Impact of Political Stability:

- Peaceful Political Transitions: Countries that experience peaceful political transitions, such as regular democratic elections or a clear line of succession, tend to maintain investor confidence over the long term. This stability allows for the consistent implementation of economic policies that support growth and development. Long-Term Economic Impact: Political stability encourages both domestic and foreign investment, supports the efficient functioning of markets, and creates an environment conducive to long-term economic growth. Countries with stable political systems are more likely to attract foreign direct investment (FDI) and see sustained growth in their economies.

- Political Instability and Economic Disruption: Conversely, political instability, such as coups, civil unrest, or authoritarian takeovers, can have devastating effects on long-term economic prospects. Political upheaval often leads to disruptions in economic activity, as businesses may flee, supply chains become fractured, and foreign investment dries up. Long-Term Economic Impact: Countries that experience long-term political instability often suffer from reduced economic growth, higher unemployment, and an inability to attract investment. Rebuilding after periods of instability can take decades, and the long-term consequences may include a significant decline in living standards and economic development.

Conclusion

Political changes around the world have significant long-term implications for the global economy. From altering trade dynamics to reshaping investment patterns, regulatory environments, and geopolitical stability, the impact of political shifts extends well beyond the immediate aftermath. Understanding these changes and their long-term effects is crucial for businesses, investors, and policymakers alike, as they navigate the complex and ever-evolving global economic landscape. Political stability, in particular, remains a key factor in fostering sustainable economic growth, while political instability can undermine economic development, potentially causing lasting disruptions in markets and industries worldwide.