- The U.S. Leads With High Rates and Strong Dollar Dominance

The Federal Reserve remains firmly in a “higher-for-longer” posture, creating a gravitational pull toward USD assets.

This:

- strengthens the dollar

- drains global liquidity

- pressures emerging market currencies

- increases funding costs worldwide

- redirects capital into U.S. markets

The dollar is not weakening—if anything, its dominance is intensifying.

- Europe Faces a Weak Cycle and Policy Constraints

The ECB is synchronized with neither the U.S. nor Asia:

- inflation remains stubborn

- growth is fragile

- fiscal space is limited

- high energy costs persist

- industrial output struggles

Europe wants to ease policy—but inflation dynamics prevent aggressive cuts.

The euro remains vulnerable.

- Asia Is a Patchwork of Diverging Monetary Strategies

Asia is not a unified region from a monetary standpoint:

- China injects liquidity selectively

- Japan edges toward normalization

- India maintains a cautious tightening stance

- ASEAN navigates inflation with mixed policies

This divergence complicates capital flows and increases volatility in FX markets.

III. Geopolitical Realignment: Finance as a Strategic Weapon

- Sanctions Are Reshaping Global Financial Networks

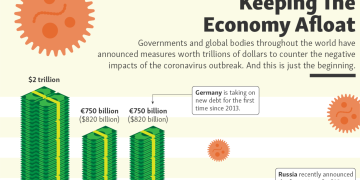

Western sanctions on Russia have accelerated the development of alternative systems:

- new interbank messaging networks

- non-USD settlement mechanisms

- regional liquidity pools

- cross-border digital currency experiments

Countries now actively prepare sanction-proof financial infrastructure.

- Supply Chains Are Becoming Geopolitical Chains

Capital follows supply chains.

As manufacturing relocates:

- FDI flows shift

- industrial financing increases in new hubs

- commodity trade corridors change

- energy financing patterns reorganize

The result is a more segmented investment landscape.

- Energy Geopolitics Is Reinforcing Financial Fragmentation

The global energy map has split into:

- the U.S. LNG bloc

- Middle Eastern petro-finance systems

- Europe’s renewable-financed transition

- Asia’s mixed energy portfolio

Energy financing increasingly reflects geopolitical alliances—not pure market logic.

IV. Technological Disruption: Finance Is Becoming Multipolar Through Innovation

- The Rise of Digital Currencies (CBDCs)

Over 130 countries are developing or testing CBDCs.

This new architecture reduces reliance on legacy networks like SWIFT and gives states more control over:

- cross-border payments

- monetary sovereignty

- capital flows

- sanctions compliance

- financial surveillance

- Tokenized Assets and Instant Settlement

Tokenization is transforming:

- bond issuance

- real estate financing

- private equity

- trade finance

- central bank collateral systems

Real-time settlement increases transparency but reduces liquidity buffers, raising new systemic risks.

- AI-Driven Financial Stability Tools

Governments and institutions are rapidly implementing AI systems for:

- risk detection

- early warning

- automated regulation

- financial fraud monitoring

- cyber-defense

Technology no longer merely supports finance; it defines it.

V. The Global South: Rising Influence and New Financial Institutions

- Emerging Markets Are No Longer Passive

Countries in the Global South are:

- forming new trade blocs

- creating alternative financing institutions

- moving toward multi-currency settlement

- demanding greater IMF and World Bank representation

- investing in local capital markets

- BRICS Expansion Is a Major Macro Trend

The expansion of BRICS marks a structural shift in global finance:

- rising non-USD commodity pricing

- cross-border local currency settlements

- new infrastructure financing channels

- growing importance of sovereign wealth funds

- Sovereign Wealth Funds as Power Brokers

SWFs from the Middle East and Asia now influence:

- technology markets

- global real estate

- venture capital

- fintech ecosystems

- green energy finance

They are becoming the new “super-investors” of global markets.

VI. Cross-Border Capital Flows: More Volatile, More Political

- Outflows From Europe and China, Inflows Into the U.S.

Current capital flow trends show:

- massive inflows into U.S. equities and bonds

- persistent outflows from Europe

- cautious outflows from China

- reallocation into India and ASEAN

- increased flows to commodity exporters

- Portfolio Flows Have Become Extremely Sensitive

Markets react more aggressively to:

- interest rate differentials

- geopolitical tensions

- supply chain announcements

- commodity shocks

- policy speeches

Volatility is not a temporary phenomenon—it is the new baseline.

- Long-Term Capital Commitments Decline

Private equity and venture capital markets face:

- reduced fundraising

- lower valuations

- longer exit timelines

- more stringent due diligence

- geographic restrictions on investment

Long-term capital is becoming more cautious and more regional.

VII. The Sovereign Debt Time Bomb

Global sovereign debt is at historic highs.

- Advanced Economies Face Fiscal Stress

The U.S., UK, France, and Italy all show:

- rising interest burdens

- expanding deficits

- political resistance to austerity

- concerns over long-term debt sustainability

- Developing Economies Are Near Crisis Thresholds

Over 50 countries are now in:

- restructuring

- pre-default negotiation

- IMF assistance

- severe FX pressure

- unsustainable interest obligations

Debt stress is becoming systemic, not regional.

- The Bond Market Is Becoming a Source of Global Risk

Bond markets were once stabilizers; now they are destabilizers:

- sudden yield spikes

- liquidity shortages

- algorithmic trading amplifiers

- loss of traditional market makers

Bond volatility today rivals equity market volatility.

VIII. Energy and Commodities: The New Financial Battleground

- Commodity Trade Bypasses Traditional Systems

More commodity transactions are settling in:

- CNY

- AED

- INR

- bilateral swap lines

- local currency payment systems

This shifts liquidity away from the dollar-centric system.

- Green Transition Is Rewiring Capital Allocation

Capital is flooding into:

- renewable infrastructure

- battery metals

- energy storage

- grid modernization

- clean technology manufacturing

But fossil fuel underinvestment creates supply risks that feed inflation.

IX. Market Behavior: A New Psychology of Fragmentation

- Investors Now Operate in “Multiple Markets” Simultaneously

Global markets no longer behave as one unit.

Investors must navigate:

- Western market cycles

- Asian liquidity cycles

- commodity-based cycles

- technology-driven cycles

- geopolitical cycles

- Risk Pricing Is No Longer Universal

The same company, bond, or commodity can be priced differently depending on:

- the region

- the trading platform

- the clearing system

- the settlement currency

- regulatory constraints

Fragmentation is reshaping asset valuation itself.

X. What the Next Decade Looks Like: Three Possible Worlds

Scenario 1: “Two Financial Blocs” (Highly Likely)

A Western bloc and an Asian/BRICS bloc operate parallel financial systems.

Scenario 2: “Network Fragmentation” (Already Happening)

Multiple overlapping networks, currencies, and standards coexist with limited interoperability.

Scenario 3: “Reintegration” (Low Probability)

A shock drives global coordination—but this requires political alignment that is unlikely.

XI. Conclusion: A Financial World That Will Never Fully Reconnect

The global financial system is not collapsing—it is reorganizing.

But unlike past cycles, this is not a temporary divergence.

It is the emergence of a permanently multipolar financial world.

Key forces driving fragmentation: - geopolitical rivalry

- technological sovereignty

- divergent monetary cycles

- rising debt burdens

- energy realignment

- capital flow volatility

- competing payment infrastructures

The next generation of global finance will be defined not by unification but by coexistence of multiple systems.

To navigate this new world, policymakers and investors must: - understand regional liquidity cycles

- monitor geopolitical linkages

- adapt to technological change

- hedge against sovereign risk

- diversify currency exposure

- anticipate regulatory fragmentation

This is the beginning of a new era—one where global finance is no longer a single system, but a mosaic of interconnected yet increasingly independent networks.