How the New Interest-Rate Cycle Is Reshaping the World Economy

Introduction: A World on the Edge of a New Financial Epoch

The global financial landscape in 2024–2025 is undergoing a structural transition that has few precedents in recent history. After nearly fifteen years of ultra-low or even negative interest rates, the world is adjusting to a monetary environment characterized by persistent inflation, elevated interest rates, diverging policy paths across major economies, and a fundamental re-pricing of risk. For decades, financial markets operated under the assumption that disinflation was the natural state of advanced economies and that central banks could reliably suppress volatility through intervention. That assumption has now collapsed.

Around the world—from Washington to Frankfurt, from Tokyo to London—governments and central banks are navigating a new monetary reality: inflation is stickier, supply-side shocks more frequent, demographics less favorable, and geopolitical tension more structurally embedded than at any point since the Cold War. These forces are driving a long-term shift away from the price-stability normality of the 1990s and early 2000s into a new era where inflation and interest rates are structurally higher.

The purpose of this article is to examine how the current global interest-rate cycle is evolving, what dynamics define it, and how this transition is reshaping the world economy—from currency markets and banking behavior to corporate investment, sovereign debt sustainability, and cross-border capital allocation.

1. The End of the Low-Rate Era: What Changed?

1.1 The structural break of 2020–2023

The period from the global financial crisis (2008) to the COVID-19 pandemic (2020) was marked by zero interest rates, quantitative easing, and subdued inflation. The world experienced one of the longest periods of synchronized monetary accommodation in history.

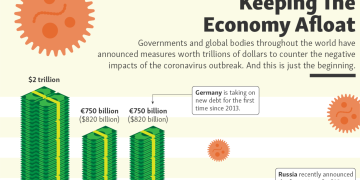

The pandemic ended that regime. Massive fiscal stimulus, supply-chain disruptions, labor-market tightening, and geopolitical fragmentation triggered inflationary pressures that proved far stronger and far more persistent than policymakers anticipated. Central banks initially underestimated the scale—calling inflation “transitory”—but rapidly reversed course in 2022 as price growth spiraled.

1.2 Inflation becomes structural, not cyclical

Unlike past cycles driven primarily by demand, today’s inflation includes deep structural components:

- Aging populations reducing labor supply

- Supply-chain regionalization increasing production costs

- Energy transition raising input prices

- Geopolitical fragmentation forcing firms to carry higher inventories

- Climate shocks causing recurrent supply disruptions

These changes imply that inflation is less likely to return to pre-2020 lows, even if growth slows.

2. The New Global Rate Regime: Higher for Longer

2.1 The Federal Reserve as the global anchor

The U.S. Federal Reserve remains the world’s monetary reference point. Even as headline inflation gradually cools, underlying inflation has stayed above target, making the Fed reluctant to cut rates aggressively. The result is a “higher-for-longer” American rate regime, which pushes up global borrowing costs because of the dollar’s dominance in trade, commodities, and financial markets.

2.2 Europe’s divergent but related trajectory

The European Central Bank (ECB) faces a different challenge: slower growth but more entrenched supply-side inflation. Europe’s energy dependency and weaker productivity make inflation harder to suppress without harming the economy. As a result:

- Europe cannot match U.S. growth

- But it also cannot safely return to ultra-low rates

Thus Europe, too, is stuck in a moderately elevated interest-rate environment, creating stress for heavily indebted countries such as Italy and France.

2.3 Japan’s historic shift

After decades of near-zero interest rates, the Bank of Japan has finally begun normalizing policy as wage growth accelerates. This has major global implications:

- Higher Japanese rates reduce Japanese investment abroad

- Yen appreciation affects global carry trades

- Japanese investors repatriate capital, tightening global liquidity

It is the quiet but significant monetary story of the decade.

3. Bond Markets Reprice an Entire Generation of Expectations

3.1 Rising yields and sovereign stress

Global bond yields have repriced dramatically. The U.S. 10-year Treasury reached levels not seen since before the 2008 financial crisis. European sovereign spreads widened, particularly in Italy, where debt sustainability becomes a recurring question.

Emerging markets face even larger challenges: many must refinance debt at much higher rates, while strong U.S. yields drain capital from their economies.

3.2 Duration risk becomes central again

For the first time in many investors’ careers, duration risk—the sensitivity of long-term bonds to rising yields—has become critical. Pension funds, insurers, and asset managers are recalibrating portfolios built for a world of perpetually low returns.

4. Banking and Corporate Finance in a High-Rate World

4.1 Banks face margin pressure and credit tensions

Higher interest rates initially boosted bank profits through wider net interest margins. But as corporate defaults begin to rise and funding costs increase, banks now face:

- higher credit losses

- tighter capital requirements

- slower loan demand

- rising competition from money-market funds

Regional banks in the U.S. remain particularly vulnerable.

4.2 Corporations confront refinancing cliffs

Corporate borrowers face a “maturity wall,” with trillions in bonds issued during the low-rate era coming due between 2025 and 2027. Refinancing at today’s rates significantly raises debt servicing costs. Expect:

- more bankruptcies, particularly among leveraged firms

- reduced share buybacks

- lower investment spending

- increased mergers for balance-sheet survival

5. Geopolitics and Inflation: The New Macro Reality

5.1 The weaponization of trade and currency

The U.S.–China rivalry and the Russia–Ukraine war have brought geopolitics directly into monetary policy:

- sanctions reshape global payment systems

- commodity prices become more volatile

- supply chains fragment

- strategic trade replaces free trade

This adds a new layer of inflationary pressure and financial uncertainty.

5.2 The rise of “security inflation”

Governments are spending heavily on:

- defense

- energy security

- reshoring

- industrial subsidies

These are politically unavoidable but financially inflationary.

6. Currency Markets in the New Rate Landscape

6.1 The U.S. dollar remains dominant

High U.S. yields and economic resilience continue to strengthen the dollar. Even as parts of the world seek de-dollarization, the dollar’s share in global transactions remains above 80%.

6.2 Euro vulnerability

The euro faces structural weaknesses:

- slower productivity growth

- fragmented fiscal governance

- energy cost exposure

As long as Europe underperforms the U.S., the euro struggles to maintain strength.

6.3 Yen volatility

Japan’s monetary transition has created sharp yen swings, affecting global funding markets. A stronger yen tightens global liquidity, while yen weakness stimulates Japanese exports but raises importing costs.

7. Investment Themes for the New Financial Epoch

7.1 Winners

- short-duration fixed income

- energy and commodity producers

- AI-driven productivity companies

- defense and industrial automation

- banks with strong balance sheets

7.2 Losers

- highly indebted companies

- long-duration bonds

- unprofitable tech

- emerging markets reliant on external financing

Conclusion: The World Must Adapt to a New Financial Normal

The world is transitioning away from the artificial calm that defined the post-2008 decade. Inflation is no longer anchored, geopolitical risks are entrenched, demographics are unfavorable, and monetary policy has lost its ultra-stimulative power. What emerges is a new regime where:

- interest rates stay structurally higher

- inflation is more volatile

- risk premiums widen

- liquidity becomes more constrained

The new financial epoch is not a temporary adjustment; it is the beginning of a long-term structural shift that will define markets, economies, and policy decisions for the next decade.