Unfolding the Vision:

Harris’s Inaugural Economic Blueprint

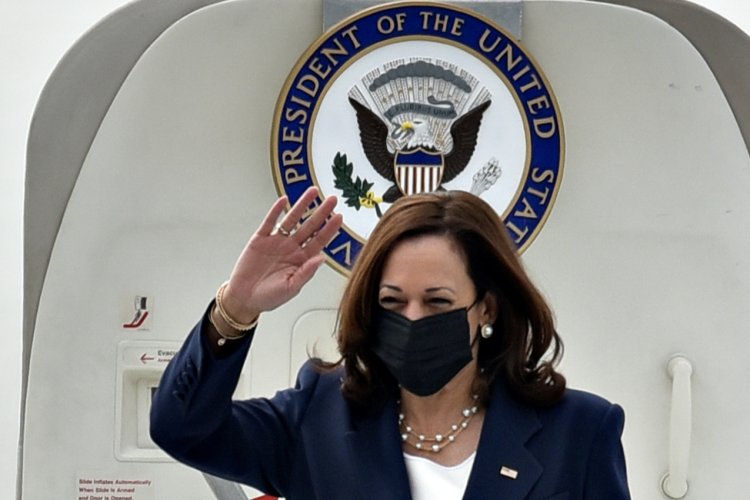

With the United States Vice President Kamala Harris stepping forward as the Democratic presidential nominee, succeeding President Biden, and the stage set for her contest against former President Donald Trump in the 2024 election, the economic focus couldn’t be more pivotal. Amidst years of high inflation, economic stewardship has climbed to the top of American voters’ concerns. The electorate is keenly attuned to the nuances between current and proposed economic policies as they ponder which direction would truly bolster their financial wellbeing.

As the Presidential election draws nearer, Harris unveiled her first economic policy agenda on August 16th. Her primary focus: the cost of living for American families. Addressing concerns like food prices, taxes, housing costs, and healthcare, Harris outlined a broad spectrum of initiatives aimed at tax reductions for the majority, curbing price gouging, lowering essentials such as groceries, and increasing the availability of affordable housing as keystones of her “Opportunity Economy.”

The Homefront Challenge:

Reducing the Cost of Living

Harris proclaimed her intention to advocate for the nation’s first federal law prohibiting price fraud on food and everyday goods. This includes empowering governmental agencies like the Federal Trade Commission (FTC) to investigate and penalize large corporations for anti-competitive practices, such as price fixing in the food and general goods industries, and to increase the penalties for raising prices unfairly, especially for daily necessities like gasoline.

Should she triumph in the election, Harris’s policies would see the continuation of a $3,600 tax credit for eligible children becoming permanent, with new $6,000 tax credits for families with infants as well as expanded earned income tax credits, effectively cutting taxes by $1,500 for front-line workers. Building on her proposed “Middle-Class Act,” Harris aims to offer a $500 monthly tax refund to those earning under $100,000, replacing the Trump-era tax policies instituted in 2017.

In addressing soaring housing costs, Harris packages a plan featuring home-buying subsidies, an increase in housing supply, and a crackdown on rent hiking practices. She pledges a $25,000 down payment subsidy for first-time buyers, the construction of 3 million new affordable homes and rental units by the end of her first term, and legislative measures to combat predatory rent increases by corporate landlords. Moreover, she promises to further reduce healthcare costs, including more substantial insurance subsidies via federal insurance marketplaces, capping out-of-pocket prescription drugs costs at $2,000 annually, and eliminating medical debt for millions of Americans.

The Fiscal Balancing Act:

Potential Strain on Long-term Government Debt

Economists weigh in, suggesting that Harris’s economic vision, punctuated by policies of reducing prices, lowering taxes, and bolstering social security, could mean an uphill battle against a fiscal deficit post-election and intensify the long-term national debt burden.

Research from the Committee for a Responsible Federal Budget (CRFB) predicts that Harris’s policies would lead to an increased deficit of $1.7 trillion over a decade (fiscal years 2026-2035). Permanent housing policies could push this number to $2 trillion. Against a GDP of $22.4 trillion in 2023, the 10-year addition of a $2 trillion deficit could raise deficit rates by an average of 0.9 percent annually, suggesting post-election fiscal policies may favor expansion over austerity. Notably, the CRFB research includes only the policies laid out in Harris’s recent address and does not account for proposed minimum wage hikes or expenditures in manufacturing sectors like renewable energy, semiconductors, or immigration fields – all of which could further compound the deficit should Harris win the election.

Polls have previously shown Trump leading Harris on economic issues – for instance, a recent survey by CNBC reveals voters believe they’d fare better economically under Trump. With economic voters reportedly favoring Trump by a 2:1 margin, it’s notable that Trump frequently capitalizes on voter economic pessimism to campaign, dubbing market downturns as ‘Kamala Crashes.’