Europe has long been a leader in the push for a more sustainable and environmentally conscious future. As the global community faces the urgent challenge of transitioning away from fossil fuels, Europe stands at the forefront of the green energy revolution, with ambitious goals and innovative policies shaping the future of energy. This article explores Europe’s role in the global green energy transition, the impact of European green policies on the global energy market, and how investors can capitalize on opportunities within Europe’s energy transformation.

Expert Analysis on Europe’s Role in the Global Green Energy Transition

- Europe’s Commitment to Sustainability

Europe’s commitment to sustainability is firmly embedded in its political and economic framework. The European Union (EU) has established a comprehensive strategy aimed at achieving carbon neutrality by 2050. This bold goal is part of the EU’s Green Deal, which focuses on decarbonizing the energy sector, fostering a circular economy, and promoting sustainability across industries. The Green Deal outlines a roadmap for reducing greenhouse gas emissions, promoting renewable energy, improving energy efficiency, and investing in green technologies.

Experts note that Europe’s green transition is not merely an internal agenda; it has become a central pillar of the continent’s foreign policy and economic strategy. With initiatives such as the European Climate Law, the EU is solidifying its position as a global leader in environmental sustainability. By positioning green energy at the heart of its policy agenda, Europe is influencing the global energy landscape, setting ambitious targets for the reduction of CO2 emissions, and promoting clean energy solutions across the globe.

- The Role of Renewable Energy in Europe’s Future

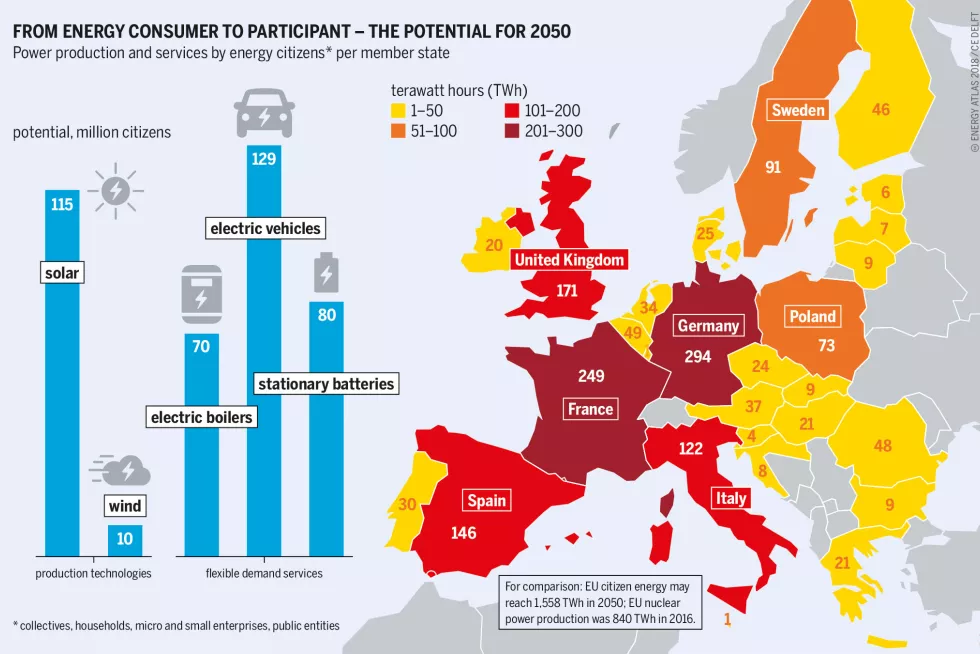

Renewable energy is at the core of Europe’s energy transformation. The EU has set the goal of producing at least 32% of its energy from renewable sources by 2030, with several countries within the EU aiming for even more ambitious targets. Wind, solar, hydro, and biomass energy are central to this strategy, with offshore wind farms and solar power generation taking center stage.

In countries like Denmark, Spain, Germany, and the Netherlands, wind and solar energy have already become key contributors to electricity production. Experts highlight that the growing integration of renewables into the European energy grid is fundamentally changing the continent’s energy mix, making it less reliant on fossil fuels. The success of Europe’s green energy policies will be a model for other regions to follow, providing insight into how to scale renewable energy, overcome technological barriers, and integrate diverse energy sources into a cohesive grid.

- Innovative Green Technologies Driving Change

Europe’s leadership in the green energy transition is also driven by technological innovation. The continent is home to some of the world’s most advanced green technologies, from offshore wind turbines and hydrogen fuel cells to smart grids and energy storage systems. These innovations are not only shaping the future of Europe’s energy landscape but also creating opportunities for global export and collaboration.

Hydrogen is one of the most promising areas of innovation, with several EU countries, including Germany, launching national hydrogen strategies aimed at scaling green hydrogen production. Green hydrogen, produced through renewable energy sources like wind and solar, is seen as a critical element in decarbonizing hard-to-abate sectors such as heavy industry and transportation. Europe’s investment in hydrogen infrastructure is paving the way for a global market for green hydrogen, positioning Europe as a key player in this emerging industry.

- Circular Economy and Green Industrial Policy

Experts argue that Europe’s green transition goes beyond energy alone; it encompasses a broader vision of a circular economy. The EU is striving to reduce waste, promote recycling, and encourage the reuse of materials in all industries. The European Commission’s Circular Economy Action Plan outlines a series of policies to promote sustainability in sectors such as construction, textiles, and electronics.

The circular economy model is gaining momentum in Europe, where industries are increasingly looking for ways to reduce their carbon footprint through sustainable production processes and the recycling of materials. This shift toward a circular economy is not only environmentally beneficial but also economically viable, as it reduces dependence on finite natural resources and encourages innovation in green technologies and materials.

- Global Cooperation and the Export of Green Energy Solutions

As Europe takes the lead in green energy transitions, it is also promoting global cooperation. The EU has been active in forging international partnerships to accelerate the green transition in other parts of the world. Through initiatives such as the European Green Deal Diplomacy, Europe is sharing its expertise in renewable energy, energy efficiency, and climate policy with other countries, particularly in developing regions.

The export of green energy technologies and knowledge is becoming an important part of Europe’s foreign policy and economic strategy. European companies are leading the way in the development and deployment of clean energy technologies, from solar panels and wind turbines to electric vehicles and energy-efficient buildings. By exporting these technologies to other regions, Europe is helping to accelerate the global transition to a low-carbon economy.

The Impact of European Green Policies on the Global Energy Market

- Driving Global Investment in Clean Energy

One of the most significant impacts of Europe’s green policies is the influx of global investment in clean energy. As European governments continue to offer financial incentives and subsidies for renewable energy projects, the continent has become an attractive destination for investors looking to capitalize on the green energy boom.

The EU’s financial instruments, such as the European Investment Bank (EIB) and the European Bank for Reconstruction and Development (EBRD), have played a crucial role in financing renewable energy projects across Europe and beyond. These institutions provide loans and grants for large-scale renewable energy projects, helping to lower the financial risk for investors. As a result, Europe has seen a significant increase in private sector investment in green energy infrastructure, which is driving the global growth of renewable energy technologies.

- Shaping Global Energy Prices and Trade Dynamics

Europe’s green policies are also influencing global energy prices and trade dynamics. As Europe shifts away from fossil fuels and increases its use of renewable energy, it is reducing its dependence on imported oil and gas. This shift has the potential to alter global energy markets by lowering demand for fossil fuels and changing global supply chains.

For instance, the EU’s commitment to carbon pricing and emissions trading systems is pushing up the cost of carbon emissions for fossil fuel companies, making renewable energy sources more competitive. As renewable energy technologies become more cost-effective and widely deployed, Europe’s energy transition will have ripple effects across global markets, potentially lowering the global price of clean energy technologies while driving up the cost of carbon-intensive fuels.

Moreover, Europe’s push for renewable energy and its aggressive climate goals are likely to have an indirect impact on other regions, encouraging them to adopt similar policies. As a result, Europe’s green energy transition is not only influencing its own energy landscape but also shaping global energy policies and market structures.

- A Catalyst for Global Policy Change

Europe’s role in driving the global green energy transition is also influencing policy changes in other regions. As the EU strengthens its climate policies and sets ambitious renewable energy targets, it is setting a standard for other governments to follow. The EU’s example has been a catalyst for policy shifts in countries like China, the U.S., and India, all of which are increasing their commitments to renewable energy and carbon reduction.

Through international organizations such as the United Nations Framework Convention on Climate Change (UNFCCC) and the Paris Agreement, Europe has been instrumental in shaping the global climate agenda. The EU’s commitment to achieving carbon neutrality by 2050, along with its policies aimed at reducing emissions and increasing the use of renewable energy, is inspiring other nations to adopt similar strategies, thereby accelerating the global transition to a low-carbon future.

- Energy Security and Geopolitical Implications

Europe’s energy transition has important geopolitical implications. As the continent reduces its reliance on fossil fuel imports, particularly from politically unstable regions, it is increasing its energy security. The shift to renewables, along with the development of local energy sources, is reducing Europe’s vulnerability to external energy price shocks and supply disruptions.

Furthermore, Europe’s transition is having geopolitical ripple effects on global energy producers, particularly oil and gas-exporting countries. As demand for fossil fuels decreases in Europe, these countries are seeking new markets for their energy exports, leading to shifts in global trade dynamics and energy alliances.

How Investors Can Capitalize on Opportunities Within Europe’s Energy Transformation

- Investing in Renewable Energy Infrastructure

One of the most straightforward ways for investors to capitalize on Europe’s green energy transformation is by investing in renewable energy infrastructure. Europe is home to some of the world’s largest offshore wind farms, solar energy installations, and biomass projects. As the EU continues to ramp up its investments in renewable energy, opportunities for investors to enter the market will continue to grow.

Investors can explore opportunities in publicly traded renewable energy companies, private equity funds focused on clean energy projects, and green bonds. Additionally, infrastructure-focused funds that target the construction of energy-efficient buildings and sustainable transportation networks are gaining popularity.

- Focusing on Green Technologies and Innovation

The growing demand for green technologies presents an attractive investment opportunity. Companies involved in the production of solar panels, wind turbines, batteries, and energy storage systems are well-positioned to benefit from Europe’s energy transition. Investors can target individual stocks in these sectors or invest in exchange-traded funds (ETFs) and mutual funds that focus on clean tech companies.

Hydrogen, in particular, presents significant potential for investors. The EU’s commitment to green hydrogen has attracted both government funding and private sector investment, making it one of the most promising emerging sectors in Europe’s energy landscape. Investors can explore opportunities in hydrogen production, distribution, and storage technologies, which are expected to play a pivotal role in Europe’s decarbonization efforts.

- Capitalizing on Energy Efficiency and Sustainability Projects

Another key area for investment is energy efficiency. Europe is investing heavily in retrofitting buildings, upgrading grid infrastructure, and improving energy efficiency in industrial processes. Companies that specialize in energy-efficient technologies, such as LED lighting, smart meters, and energy management systems, are likely to see significant growth as Europe continues its push toward carbon neutrality.

Additionally, sustainable finance is growing in prominence. Investors can target green bonds, sustainable real estate investments, and

ESG (Environmental, Social, and Governance) funds that focus on companies with strong environmental practices and sustainability initiatives. These investments not only provide attractive returns but also align with broader global trends toward responsible and sustainable investing.

- Exploring Cross-Border Green Energy Ventures

With Europe leading the charge on green energy, cross-border investments in renewable energy projects are on the rise. Investors can look beyond individual countries and explore opportunities to invest in multi-national green energy ventures. This includes joint ventures, partnerships, and multinational renewable energy projects that span across several European markets.

By participating in international green energy initiatives, investors can diversify their portfolios while capitalizing on Europe’s leadership in renewable energy innovation and policy development.

Conclusion

Europe’s role in the global green energy transition is pivotal, with the continent driving innovations in renewable energy technologies, shaping global energy policies, and creating new opportunities for sustainable investment. As Europe continues to transition to a green energy future, it will set the standard for other regions to follow and remain a key player in the global energy market.

Investors have a unique opportunity to capitalize on Europe’s green transformation by targeting renewable energy infrastructure, green technologies, energy efficiency projects, and sustainable finance initiatives. By aligning investments with Europe’s green policies and objectives, investors can position themselves to benefit from the growth of the clean energy sector while contributing to the global fight against climate change.