The Nikkei 225, one of the most prominent stock market indices in Asia, has seen a remarkable rebound in recent years, stirring interest among global investors. Understanding the historical context, the driving factors behind its recovery, the key sectors contributing to this growth, and its broader implications for foreign investors are essential for grasping the significance of the Nikkei 225’s performance in today’s global economy.

I. Historical Context of the Nikkei 225 Index

The Nikkei 225, often referred to simply as the Nikkei, is Japan’s primary stock market index, representing the performance of 225 top-tier companies listed on the Tokyo Stock Exchange (TSE). Established in 1950, it provides a snapshot of the health of Japan’s economy and the global marketplace. The index is price-weighted, meaning that companies with higher stock prices have a greater influence on its performance.

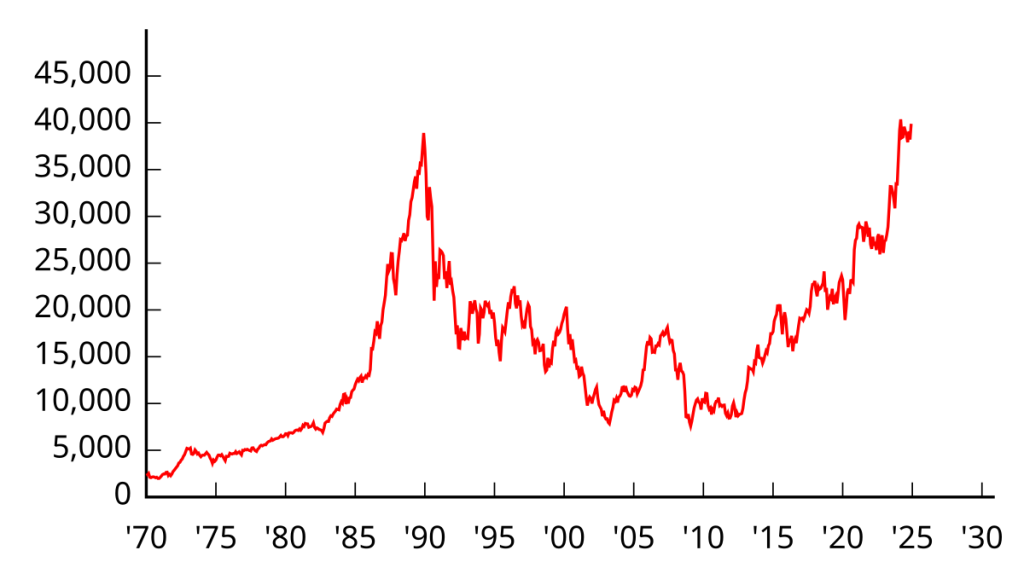

Japan has long been a key player in the global economy, and the Nikkei has mirrored its national financial landscape. In the late 1980s, Japan experienced an economic boom, fueled by speculative investment and an overinflated real estate market. The Nikkei 225 surged to an all-time high of 38,915.87 points in December 1989, making it the second-largest stock index in the world at the time.

However, the 1990s marked the beginning of a prolonged period of stagnation known as the “Lost Decade,” as Japan’s economy faltered and asset bubbles burst. This caused the Nikkei to enter a long-term bear market, falling below 8,000 points by the early 2000s.

The Nikkei’s subsequent recovery attempts were often hindered by domestic challenges such as an aging population, deflation, and global economic crises, including the 2008 financial meltdown. Despite this, Japan’s industrial sectors like automotive and electronics remained influential, with companies like Toyota, Sony, and Panasonic consistently contributing to the index’s performance.

II. Recent Market Trends and Driving Factors Behind Its Recovery

In the years following the COVID-19 pandemic, the Nikkei 225 has experienced a substantial recovery. By 2023, the index had regained much of its pre-pandemic losses, reaching levels not seen since the late 1980s. This resurgence can be attributed to a variety of factors, both domestic and international.

A. Japan’s Economic Reforms

One of the key driving forces behind the Nikkei’s rebound has been the government’s economic reforms. Under Prime Minister Shinzo Abe, who served from 2012 until his tragic assassination in 2022, Japan implemented a set of policies known as “Abenomics.” These reforms focused on three “arrows”: monetary easing, fiscal stimulus, and structural reforms aimed at revitalizing Japan’s economy.

The Bank of Japan’s aggressive monetary policies, including negative interest rates and quantitative easing, have played a significant role in stimulating market growth. These policies have helped lower borrowing costs for businesses and encouraged investment, which has buoyed the stock market, including the Nikkei 225.

B. Global Supply Chain Reshuffling

The pandemic-induced disruptions in global supply chains have prompted many companies to reevaluate their reliance on China and other low-cost manufacturing hubs. As a result, Japan has seen a rise in reshoring and diversification of manufacturing operations, which has benefited companies listed on the Nikkei.

Japan’s reputation for high-quality manufacturing, particularly in industries such as automotive and electronics, has led to increased global demand for products made in Japan. Companies like Toyota, Nissan, and Honda have capitalized on this trend, leading to greater profitability and, consequently, a stronger Nikkei performance.

C. Technological Advancements and Digitalization

Japan has also capitalized on advancements in technology, particularly in sectors like robotics, semiconductors, and artificial intelligence (AI). The government’s commitment to innovation, along with private-sector investments, has helped transform Japan into a leader in these cutting-edge fields.

Japan’s semiconductor industry, in particular, has been a focal point of growth. Companies like Tokyo Electron and Renesas have been at the forefront of the global semiconductor shortage, benefiting from the increasing demand for microchips across various industries, from automotive to consumer electronics.

D. Global Recovery and Rising Risk Appetite

Global markets have also experienced a significant recovery post-pandemic, with many economies emerging from lockdowns and restrictions. The rise in risk appetite among investors, fueled by the expectation of sustained global economic growth, has contributed to rising stock markets, including the Nikkei 225.

Japan, with its stable political environment and strong industrial base, has become an attractive investment destination for foreign investors seeking exposure to Asian markets without the perceived risks of other regions. This has bolstered investor sentiment and contributed to the