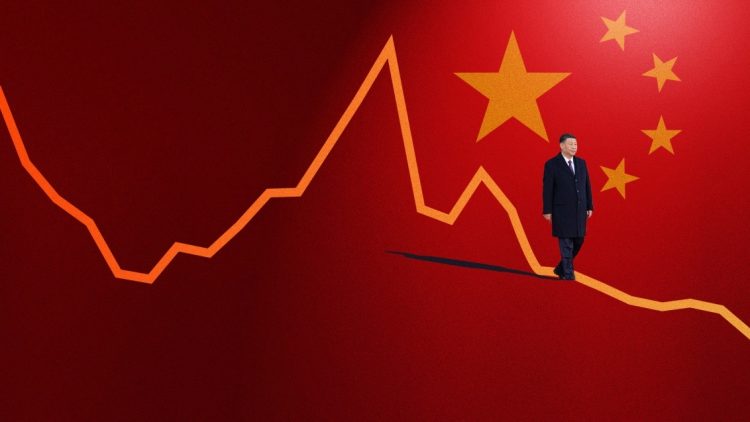

Introduction: Analysis of China’s Transition from an Export-Driven Economy to a Consumption-Based Economy and Its Broader Implications for Global Markets

Over the past few decades, China has been known as the “world’s factory,” a manufacturing powerhouse that produced and exported goods to every corner of the globe. This export-driven model fueled the country’s rapid economic growth and helped lift millions out of poverty. However, as China continues to evolve and modernize its economy, a shift is taking place—one from a manufacturing-driven, export-focused economy to a consumption-based model.

This transition is crucial not only for China but also for the global economy. As China’s middle class grows and its domestic consumption increases, it is poised to become the largest consumer market in the world. This shift has profound implications for trade relationships, global supply chains, and investment patterns. The move toward consumption represents a fundamental change in the way China’s economy operates and offers both challenges and opportunities for domestic and international stakeholders.

This article will delve into the key drivers of this transition, the sectors most affected, and the implications for global markets. We will also explore how investors can navigate this evolving economic landscape and assess whether China can successfully manage the challenges that come with this shift.

Sector Shifts: The Growing Importance of the Services and Technology Sectors Over Traditional Manufacturing

One of the most notable features of China’s economic transformation is the shift from manufacturing to services and technology. For decades, manufacturing—particularly in industries like electronics, textiles, and steel—was the backbone of the Chinese economy. But as wages rise, labor costs increase, and environmental concerns take center stage, China is increasingly focusing on sectors that contribute more to domestic consumption rather than export-driven manufacturing.

The Services Sector: A New Engine for Growth

The services sector is expanding rapidly in China, encompassing everything from financial services, healthcare, and real estate, to retail and entertainment. The rise of a burgeoning middle class has driven demand for services ranging from healthcare to education, creating new avenues for growth in the domestic economy. According to the World Bank, services now account for more than half of China’s GDP, marking a significant shift from previous decades when the economy was heavily dependent on manufacturing and construction.

For example, the Chinese government has been actively encouraging industries such as technology services, logistics, and financial services, all of which are key drivers of consumption. In cities like Shanghai and Beijing, the services sector has already outpaced manufacturing in terms of economic contribution. The rise of e-commerce and digital finance, particularly driven by platforms like Alibaba and Tencent, also falls within this burgeoning services sector, creating a new growth engine for the economy.

Technology and Innovation: China’s New Growth Driver

Another critical sector experiencing explosive growth in China is technology. The government’s Made in China 2025 initiative is designed to propel the country to the forefront of high-tech industries such as artificial intelligence, 5G, biotechnology, and robotics. China is becoming a global leader in tech innovation, with companies like Huawei, ByteDance, and JD.com driving growth in areas like smart manufacturing, autonomous vehicles, and e-commerce platforms.

The tech sector is already a key pillar of China’s economy, and it is expected to grow even more as domestic consumption shifts towards tech products and services. For instance, smartphones, smart home devices, and electric vehicles (EVs) are becoming staples in the Chinese consumer market, which is a significant shift from the previous reliance on traditional manufactured goods for export. This growing focus on technology not only benefits domestic consumers but also propels China to the forefront of global technological competition.

Impact on Trade: How the Shift Affects China’s Trade Partners and Global Supply Chains, Particularly in the U.S. and Europe

As China’s consumption-driven economy takes hold, the effects on its global trade relationships are becoming increasingly apparent. Traditional trade flows, which once saw China as the world’s factory exporting vast quantities of manufactured goods, are shifting. The implications of these changes are most evident in its trade ties with the U.S., Europe, and other major markets.

Trade with the U.S.: Moving Toward a Consumption-Focused Relationship

China’s shift to a consumption-based economy is likely to reshape its trade relationship with the United States. The U.S. has long been one of China’s largest export markets, particularly for electronics, textiles, and machinery. However, as China increasingly turns inward, demand for its exported goods may slow down, leading to potential changes in the trade balance between the two countries.

With the focus shifting from export-led growth to consumption-led growth, China’s import needs—particularly in high-end goods and services—will rise. This could offer opportunities for U.S. businesses, especially those in technology, luxury goods, and financial services sectors. However, ongoing trade tensions, such as the U.S.-China trade war, may continue to complicate this dynamic. Despite the shift, China is still expected to be a major player in global supply chains, though it may increasingly import more advanced products and technology, rather than simply exporting finished goods.

Impact on Europe: Shifting Trade Patterns and Opportunities for Growth

In Europe, China’s shift is likely to lead to both challenges and opportunities. European countries have historically relied on Chinese demand for manufactured goods, such as machinery, automotive parts, and electronics. However, as the Chinese economy rebalances toward consumption, it could reduce demand for traditional exports, leading to potential disruptions in European manufacturing sectors.

On the flip side, Europe’s high-quality goods—such as luxury brands, automobiles, and pharmaceuticals—are well-positioned to meet the growing demand from China’s rising middle class. European companies, particularly in luxury goods, fashion, and automotive industries, stand to benefit as Chinese consumers shift toward spending on premium products. For example, brands like Mercedes-Benz, Louis Vuitton, and Rolls-Royce have witnessed surging demand from China’s wealthier consumers.

Furthermore, Europe can capitalize on China’s technological shift, as the demand for green technologies, AI solutions, and financial services grows. European companies in renewable energy, electric vehicles, and FinTech may find new growth opportunities in China’s consumption-driven economy.

Supply Chain Disruptions and Adjustments

The ongoing shift will also affect global supply chains. As China reduces its emphasis on manufacturing, companies in other regions may begin to see opportunities to take on more of the production responsibilities. Southeast Asian nations such as Vietnam, Indonesia, and India stand to benefit from China’s shift away from low-cost manufacturing, as companies look to diversify their supply chains and reduce reliance on Chinese manufacturing.

At the same time, as China increasingly becomes a net importer of high-tech products, global supply chains will need to adapt to the demand for more advanced technologies and services. For example, the demand for semiconductors, robotics, and green energy solutions will rise, reshaping global manufacturing and trade patterns.

Investment Landscape: What This Transition Means for Investors, with a Focus on Consumer Goods, E-Commerce, and Tech Stocks

For investors, China’s economic transition presents both opportunities and risks. The move toward a consumption-driven economy presents numerous opportunities, particularly in the consumer goods, e-commerce, and technology sectors.

Consumer Goods: Capitalizing on China’s Growing Middle Class

With the shift toward a consumption-based economy, Chinese consumers are spending more on goods and services rather than simply buying low-cost manufactured products. As a result, consumer goods companies focused on serving China’s middle class are expected to experience strong growth. Companies in sectors such as food and beverage, healthcare, and luxury goods stand to benefit from this rising demand.

Investors can look to companies like Alibaba, JD.com, and Pinduoduo, which are all benefitting from China’s expanding e-commerce market. As the middle class continues to grow, consumer spending on both domestic and imported goods will increase, presenting significant opportunities for brands that cater to these consumers.

E-Commerce and Online Retail: A Booming Sector

China’s e-commerce market is already the largest in the world, and it is expected to continue expanding rapidly. Online retail, including mobile commerce and social commerce, is a particularly lucrative area. Chinese companies like Alibaba and Tencent, along with smaller players in online travel, education, and entertainment, will likely see significant growth as more Chinese consumers engage with digital platforms.

Tech Stocks: The Future of China’s Technological Evolution

The technology sector is one of the most promising areas of China’s economic shift. With an emphasis on AI, cloud computing, and electric vehicles, the growth of Chinese tech companies like Baidu, Huawei, Xiaomi, and NIO offers investors exposure to the future of innovation in China. As China moves away from low-cost manufacturing and focuses more on high-tech development, these companies could see strong demand both domestically and globally.

Outlook: Can China Successfully Navigate This Economic Shift, or Will Challenges Like the Real Estate Crisis Impede Progress?

The outlook for China’s transition is mixed. While there are enormous opportunities in the services, tech, and consumer sectors

, there are also significant challenges. The real estate crisis, rising debt levels, and trade tensions with the U.S. and other countries could potentially impede the progress of China’s economic rebalancing.

China will need to manage these risks effectively to ensure the smooth transition from an export-driven economy to a consumption-driven one. Whether it can succeed remains to be seen, but one thing is clear: the shift has already begun, and its impact on global markets will only grow.