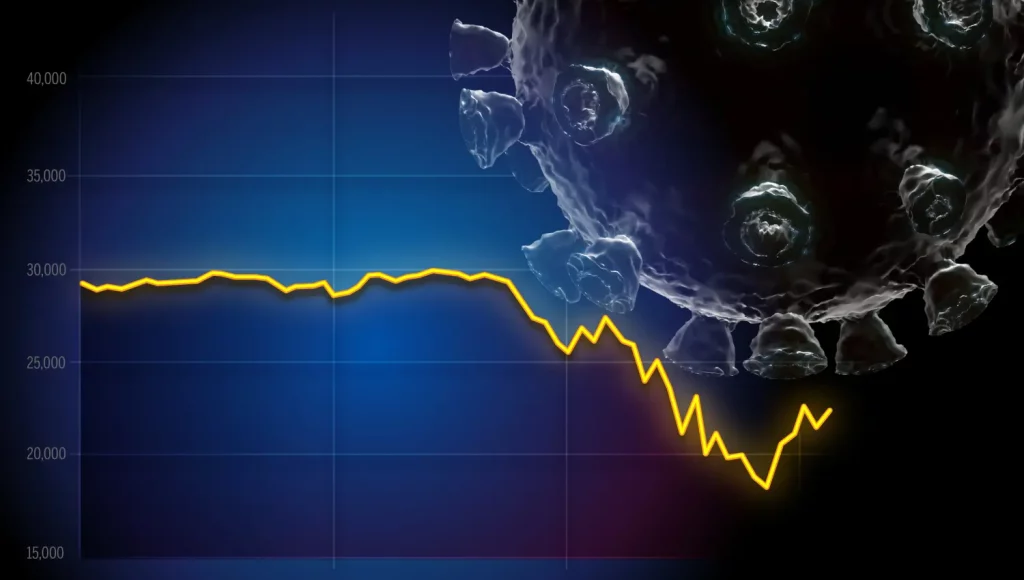

The COVID-19 pandemic caused unprecedented disruptions across the world, affecting nearly every sector of the global economy. Among the hardest hit was Europe, a continent that faced significant public health challenges, economic contractions, and political uncertainties. However, as the world begins to recover from the pandemic, European economies are slowly recovering, showing resilience and adapting to the new post-pandemic reality. This article delves into expert opinions on Europe’s economic recovery post-COVID, how this recovery is influencing investment strategies, and the relationship between global economic conditions and Europe’s recovery.

Expert Opinions on the Economic Recovery of Europe After the Pandemic

- The Resilience of European Economies

Experts widely agree that European economies have shown remarkable resilience in the face of the COVID-19 crisis. Despite the severe downturn in economic activity in 2020, Europe’s recovery is considered one of the most promising among major global economies. According to the European Central Bank (ECB), the euro area saw a rapid rebound in 2021 as vaccination campaigns were rolled out and businesses started reopening.

Economists emphasize that Europe’s recovery is largely driven by the swift implementation of fiscal stimulus packages and the European Union’s joint recovery effort. One of the most significant steps taken by the EU was the launch of the €750 billion “NextGenerationEU” recovery fund, which was aimed at stimulating growth, reducing inequalities, and funding green and digital transitions across member states. The EU’s collective approach to the recovery, particularly through investing in sustainable projects, has been praised as a strategy that will drive long-term economic resilience.

- Sectoral Variations in Recovery Rates

However, experts point out that the recovery process has not been uniform across all sectors or countries in Europe. While the technology, pharmaceutical, and renewable energy sectors have shown robust growth, industries such as tourism, hospitality, and transportation have been slower to recover. For instance, southern European countries like Spain and Italy, which rely heavily on tourism, have faced slower economic recoveries compared to northern European nations like Germany and the Netherlands, which have stronger industrial bases.

The disparity in recovery between sectors and countries has led some economists to suggest that the European recovery will be uneven in the short term. As a result, countries with higher exposure to hard-hit sectors might take longer to return to pre-pandemic levels of economic activity. Nonetheless, the overall trend is positive, and experts forecast that the eurozone will continue to recover steadily, driven by robust government intervention and stronger-than-expected consumer demand.

- Digital Transformation and Green Recovery

Another crucial area highlighted by experts is the ongoing digital transformation and green recovery. The pandemic has accelerated the adoption of digital technologies across Europe, especially in areas such as e-commerce, fintech, remote working, and education. Experts emphasize that European countries are making significant strides in harnessing digital tools to promote economic growth and enhance productivity.

Similarly, the push for a green recovery is gaining momentum. Experts point to the EU’s Green Deal as a blueprint for reducing carbon emissions and transitioning toward a sustainable economy. By investing in green technologies, clean energy, and environmentally friendly infrastructure, Europe is positioning itself as a leader in climate action, creating new business opportunities and jobs in the process. The success of this green transition is critical not only for the long-term economic health of the region but also for attracting investment in the future.

- Challenges Ahead: Inflation, Labor Shortages, and Debt

Despite the optimism, economists caution that Europe’s recovery faces several challenges. One of the most pressing issues is the rise in inflation, which has been exacerbated by supply chain disruptions, increased energy prices, and labor shortages in key sectors. As inflationary pressures build, central banks in Europe may face difficult decisions on whether to tighten monetary policy or continue supporting economic recovery through low interest rates.

Labor shortages are also a growing concern, particularly in sectors that have experienced significant disruptions, such as healthcare, logistics, and manufacturing. Experts warn that the pandemic has highlighted deep-rooted labor market issues in Europe, including skills mismatches and insufficient workforce mobility. Addressing these issues will require a concerted effort to invest in training and education programs, as well as creating policies that promote labor market flexibility.

Debt levels in European countries, particularly in Southern Europe, have also increased significantly due to pandemic-related fiscal spending. Economists note that the need to balance fiscal stimulus with long-term sustainability is crucial for avoiding potential debt crises down the line. The EU will likely need to carefully monitor its fiscal and monetary policies to ensure that the recovery is both robust and sustainable.

How Europe’s Economic Recovery Is Influencing Investment Strategies

- Opportunities in Technology and Innovation

The recovery of European economies is reshaping investment opportunities, particularly in sectors that have been boosted by the pandemic’s effects. Digital transformation is one such sector that has seen increased investment, as companies across Europe embrace technology to streamline operations and engage with consumers more effectively. Investment in artificial intelligence (AI), cybersecurity, cloud computing, and fintech has surged, as both startups and established firms seek to capitalize on the digital revolution.

Investors are also looking closely at European markets for opportunities in innovation-driven sectors, particularly in countries like Germany, Sweden, and the United Kingdom. These nations have long been leaders in industries like automotive manufacturing (with the shift toward electric vehicles), biotechnology, and renewable energy. Europe’s green recovery and strong regulatory frameworks for tech innovation are making these sectors attractive to global investors.

- Sustainability and ESG Investments

One of the most prominent shifts in investment strategies post-COVID has been the increased focus on sustainability and environmental, social, and governance (ESG) factors. Europe is home to some of the world’s most active investors in green technologies and ESG-compliant businesses. The European Green Deal and commitments to achieving carbon neutrality by 2050 have made the continent an attractive hub for sustainable investments.

Financial institutions, pension funds, and private equity firms are increasingly incorporating ESG criteria into their decision-making processes. Investors are also paying more attention to companies with strong sustainability credentials, whether they are in renewable energy, sustainable agriculture, or green infrastructure. This trend has led to the rise of green bonds and ESG-focused investment funds, which allow investors to align their financial goals with environmental and social impact.

- Regional Disparities and Targeted Investment

As mentioned earlier, Europe’s recovery is not uniform across all sectors or countries. This regional disparity presents a unique investment landscape. While northern European economies may show quicker recoveries due to their industrial prowess, southern European nations are increasingly looking for external investments to boost their growth. Countries like Spain, Italy, and Greece are receiving attention from foreign investors seeking opportunities in real estate, tourism, and sustainable infrastructure projects.

Investors are taking a more targeted approach to European markets, looking at sectors and regions that are poised for significant growth. For example, real estate investors are exploring opportunities in the affordable housing market in Eastern Europe, while others are capitalizing on the rising demand for digital infrastructure in countries like Ireland and Estonia.

- Private Equity and Venture Capital

The recovery of Europe has also increased the appetite for private equity (PE) and venture capital (VC) investments. PE firms are eyeing European companies that have emerged from the pandemic with enhanced digital capabilities and more robust financial structures. Additionally, there is a growing trend of VC firms focusing on startups involved in high-growth sectors, such as biotech, healthtech, and fintech.

The European Union’s support for innovation and entrepreneurship is making the continent an attractive destination for venture capital. The European Investment Fund, alongside national development banks, is actively investing in high-potential startups, which are attracting substantial global investment. The post-pandemic recovery is encouraging more risk-taking in the venture capital space, particularly in tech and sustainable industries.

- Bond Markets and Government Debt

With interest rates remaining low in Europe, investors are increasingly looking at government bonds as a relatively safe haven. However, experts point out that rising debt levels could affect the yields on government bonds in the long term, especially in countries with high debt-to-GDP ratios. As a result, investors are closely monitoring fiscal policies and debt management strategies implemented by the European Central Bank (ECB) and national governments.

European corporate bonds, particularly those in the green and tech sectors, are also becoming more attractive. These bonds offer a blend of stability and sustainability, aligning with the growing demand for investments that contribute positively to environmental and social outcomes.

The Relationship Between Global Economic Conditions and Europe’s Recovery

- Global Supply Chains and European Trade

Europe’s recovery is deeply intertwined with global economic conditions, particularly when it comes to trade and supply chains. The disruption of global supply chains during the pandemic severely impacted European economies, especially those dependent on manufacturing and exports. The global shortage of semiconductors, for example, has hurt European automotive and tech companies.

As global supply chains recover, Europe’s industrial and manufacturing sectors are expected to see an improvement. However, the ongoing global challenges, such as energy price volatility, trade tensions, and labor shortages, will continue to affect Europe’s recovery trajectory. Experts argue that Europe’s ability to adapt to new global trade dynamics will be crucial in sustaining its recovery.

- Monetary and Fiscal Policy Coordination

Europe’s recovery is also influenced by global monetary and fiscal policies. Central banks across the world, including the ECB, are facing difficult decisions about when to tighten monetary policies without stalling recovery. Additionally, global inflationary pressures, partly driven by supply chain disruptions and rising energy costs, have a direct impact on Europe’s economic outlook.

The coordination of fiscal and monetary policies at the global level will be key to sustaining Europe’s recovery. A slowdown in global growth or tightening financial conditions in major economies like the U.S. and China could affect Europe’s export demand and capital flows, slowing down its recovery.

- Geopolitical and Trade Tensions

Geopolitical risks and trade tensions between major economies will continue to influence Europe’s economic recovery. Issues such as Brexit, trade policies between the EU and the U.S., and tensions between China and the West will likely have ripple effects on European markets. For instance,

tariffs on European goods could hinder trade with key global partners, slowing the region’s growth prospects.

Conclusion

Europe’s economic recovery post-COVID presents a dynamic and complex landscape, with a mix of challenges and opportunities. Expert opinions highlight the continent’s resilience and the positive momentum driven by fiscal stimulus, digital transformation, and green recovery initiatives. However, the road to full recovery remains uneven across sectors and countries, and investors must remain vigilant about regional disparities, inflation risks, and the global economic environment.

Investment strategies are adapting to this new reality, with a focus on technology, sustainability, and regional opportunities. As Europe continues its recovery journey, understanding the interplay between global economic conditions and local factors will be key for navigating the evolving market landscape.