The global energy crisis has been an ongoing issue, and Europe has felt its impact deeply in recent years. From geopolitical tensions to fluctuating energy prices, the reliance on fossil fuels, particularly natural gas and oil, has left Europe vulnerable to energy supply disruptions and price volatility. In light of the recent energy crisis, many European nations are now more focused than ever on achieving energy independence and embracing sustainable energy solutions. The goal is to reduce reliance on external energy sources while simultaneously fostering a greener, more sustainable energy system.

This article explores the challenges Europe faces in addressing its energy crisis and examines the strategies and opportunities that will help the region achieve energy independence and sustainable development.

1. The Energy Crisis: A Snapshot of Europe’s Current Challenges

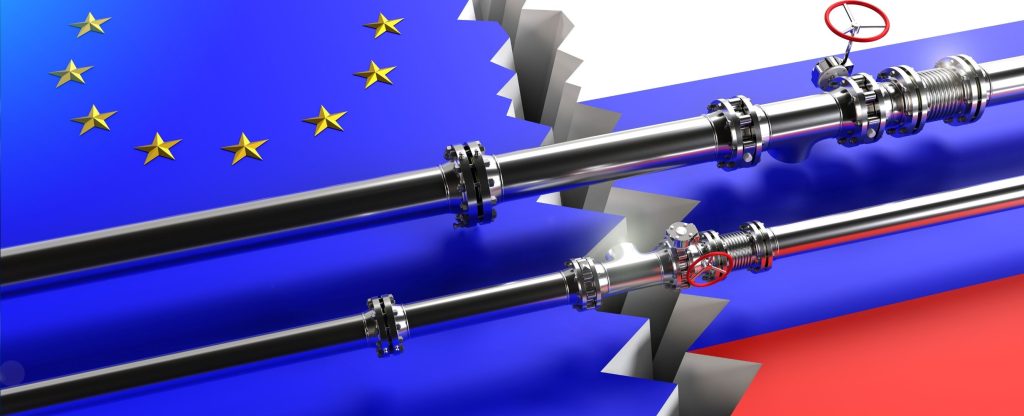

The energy crisis in Europe has been driven by several factors, some of which have been long-standing, while others have been exacerbated by recent geopolitical events. The region’s dependence on imports for a significant portion of its energy needs, particularly from Russia, has made it vulnerable to energy shortages and price hikes.

1.1. Dependency on Fossil Fuel Imports

Europe has long been reliant on fossil fuel imports, including natural gas, oil, and coal. Natural gas, in particular, has been a critical energy source for heating, electricity generation, and industry. A large portion of Europe’s natural gas came from Russia, and with the ongoing conflict between Russia and Ukraine, the continent has faced significant disruptions in energy supply, leading to price hikes and increased uncertainty.

1.2. Geopolitical Tensions and Market Volatility

The geopolitical situation in Europe has highlighted the region’s vulnerability. As Russia reduced its energy exports to Europe, European countries faced difficulties in securing energy supplies. Meanwhile, global energy markets have seen a rise in commodity prices, further intensifying the financial burden on consumers and industries.

1.3. Rising Energy Prices

The energy crisis has seen an alarming rise in energy prices, affecting businesses and households alike. This is particularly concerning in the context of Europe’s recovery from the COVID-19 pandemic, which had already strained economic resources. The price hikes are putting pressure on both individual households and the industries that rely heavily on energy inputs, such as manufacturing and transportation.

1.4. Climate Change and Sustainability Pressures

At the same time, Europe faces significant pressure to meet its climate goals. The European Green Deal, with its ambitious targets to reduce carbon emissions by 55% by 2030 and achieve net-zero emissions by 2050, requires substantial investments in clean energy and a rapid transition away from fossil fuels. This transition is complicated by the ongoing energy crisis, as Europe tries to balance short-term energy security with long-term sustainability goals.

2. The Path to Energy Independence

To achieve energy independence, Europe must reduce its reliance on foreign energy sources, diversify its energy supply, and develop homegrown energy solutions. This transition will require significant investment in infrastructure, technology, and innovation across various sectors. Key strategies to achieve energy independence include:

2.1. Diversifying Energy Supply Sources

One of the key goals for Europe is to reduce dependence on any single external energy supplier, particularly Russia. Diversification of energy supply is essential for ensuring energy security and avoiding the risks associated with geopolitical tensions. To do so, Europe is focusing on several key strategies:

- Alternative Gas Sources: In the short term, Europe has been working to diversify its natural gas sources. This includes increasing imports of liquefied natural gas (LNG) from countries like the United States, Qatar, and Norway. Europe is also exploring pipeline connections with North Africa, particularly Algeria, as a more stable source of natural gas.

- Energy Storage and Flexibility: Europe needs to invest in energy storage technologies to ensure that intermittent renewable energy sources like wind and solar can be reliably integrated into the grid. Energy storage systems can smooth out supply fluctuations and provide backup during periods of low renewable energy generation, such as during cloudy days or calm periods with no wind.

- Regional Energy Cooperation: Strengthening energy cooperation among EU member states will be crucial. The EU can leverage its collective purchasing power and negotiate better terms for energy imports, particularly for LNG. Additionally, shared infrastructure such as cross-border electricity grids and gas pipelines can help ensure a more reliable and flexible energy supply.

2.2. Investing in Renewable Energy

The transition to renewable energy is central to Europe’s long-term energy strategy. Investing in renewable energy sources like wind, solar, and hydropower will reduce Europe’s reliance on imported fossil fuels while aligning with the EU’s climate goals. Key efforts include:

- Offshore Wind: Europe is already a global leader in offshore wind energy, particularly in the North Sea. The EU has set ambitious targets for offshore wind energy, which could contribute to the decarbonization of electricity generation. Offshore wind farms provide a significant opportunity for Europe to harness the power of winds in the sea, which are often stronger and more consistent than those on land.

- Solar Power Expansion: Solar power remains one of the fastest-growing renewable energy sources in Europe. Many European countries, particularly in the Mediterranean, have significant potential for solar energy production. Increasing investments in solar infrastructure, both at the residential and commercial levels, will help reduce dependence on fossil fuels.

- Green Hydrogen: Green hydrogen, produced through the electrolysis of water using renewable electricity, is increasingly seen as a key energy carrier in Europe’s future energy system. Hydrogen can be used in industries like steel manufacturing, heavy transport, and chemical production, which are difficult to decarbonize with electricity alone. Europe is making significant strides in developing hydrogen infrastructure, including projects like the Hydrogen Backbone in the EU.

- Bioenergy: Biomass, biofuels, and biogas are additional renewable energy sources that Europe can harness. Bioenergy can help decarbonize heating and power generation, particularly in countries with strong agricultural sectors, such as France and Germany.

2.3. Energy Efficiency and Demand Reduction

Reducing energy consumption through efficiency improvements is another key element of Europe’s strategy for energy independence. This can be achieved through:

- Building Retrofits: Improving the energy efficiency of buildings is one of the most cost-effective ways to reduce energy consumption. Many buildings in Europe are old and inefficient, with poor insulation and outdated heating systems. Retrofitting buildings to meet modern energy efficiency standards can significantly reduce energy demand and help households and businesses lower their energy bills.

- Industrial Efficiency: Europe’s industries are major energy consumers, so increasing energy efficiency in manufacturing and heavy industries is a priority. The use of digital technologies, automation, and smart grids can help optimize energy use in industrial processes. This would also help reduce the carbon footprint of European manufacturing, particularly in energy-intensive sectors like steel, cement, and chemicals.

- Smart Grids and Digitalization: The implementation of smart grids can enable more efficient energy distribution, reduce losses, and allow consumers to better manage their energy consumption. Digital technologies such as artificial intelligence (AI) and big data can optimize the operation of energy systems and enhance the integration of renewable energy sources into the grid.

2.4. Promoting Energy Storage and Grid Modernization

To address the intermittency of renewable energy sources, Europe must invest in energy storage solutions such as batteries, pumped hydro storage, and advanced thermal storage technologies. These solutions would allow Europe to store excess energy produced during periods of high renewable generation and release it during times of low generation, ensuring a stable and reliable energy supply.

Grid modernization is also critical to enable the integration of decentralized and renewable energy sources. Investments in smart grids, which can dynamically manage energy flows, are essential for balancing supply and demand across Europe’s energy markets.

3. Sustainable Development and Climate Goals

The goal of achieving energy independence is closely tied to Europe’s broader sustainable development and climate goals. The European Green Deal outlines the EU’s plan to achieve net-zero carbon emissions by 2050, and this will require a massive transformation of the energy sector. Some key components of this transformation include:

3.1. Decarbonizing Industry

As industries contribute significantly to Europe’s overall carbon emissions, decarbonizing industrial processes will be a critical step in achieving sustainable development. This will require the adoption of green technologies such as hydrogen-powered steel production, carbon capture and storage (CCS) technologies, and electrification of industrial processes.

3.2. Promoting Circular Economy Principles

A circular economy model that emphasizes the reuse, recycling, and repurposing of materials can also help reduce energy consumption and minimize waste. By promoting a circular economy, Europe can reduce its reliance on raw materials and minimize the environmental impact of production processes.

3.3. Sustainable Mobility

Reducing the carbon footprint of the transportation sector is another major challenge for achieving sustainability. Europe is already leading the charge in electric mobility, with widespread investments in EV infrastructure, subsidies for electric vehicle purchases, and a commitment to phase out internal combustion engine vehicles by 2035.

Public transportation systems, cycling infrastructure, and shared mobility services will also play a role in reducing emissions from urban transport.

4. Conclusion: A Path to Energy Independence and Sustainable Development

The energy crisis in Europe has underscored the urgency of achieving energy independence and embracing sustainable energy solutions. While the road ahead is filled with challenges, including the need for significant investments and technological innovation, Europe has the potential to reduce its reliance on external energy sources and create a more sustainable, resilient energy system.

By focusing on renewable energy, improving energy efficiency, and promoting green technologies like hydrogen and energy storage, Europe can achieve its goals of energy independence and contribute to global efforts to mitigate climate change. As the region continues its transition to a low-carbon economy, it must also prioritize collaboration, innovation, and long-term investment to ensure that energy security and sustainability go hand in hand.