When former President Donald Trump floated a proposal for a blanket 10% tariff on all imports and a 60% duty on Chinese goods in his bid for a second term, critics and economists alike scrambled to unpack the implications. But by early 2025, the term “Donald-25” had already begun circulating among trade analysts, referring to the potential introduction of a sweeping new tariff regime—one that could dwarf his first-term measures and send tremors through the delicate fabric of global commerce. Much more than a political slogan, Donald-25 is emerging as shorthand for an aggressive new era of American protectionism.

The Rise of “Donald-25”: A Tariff Blueprint with Global Consequences

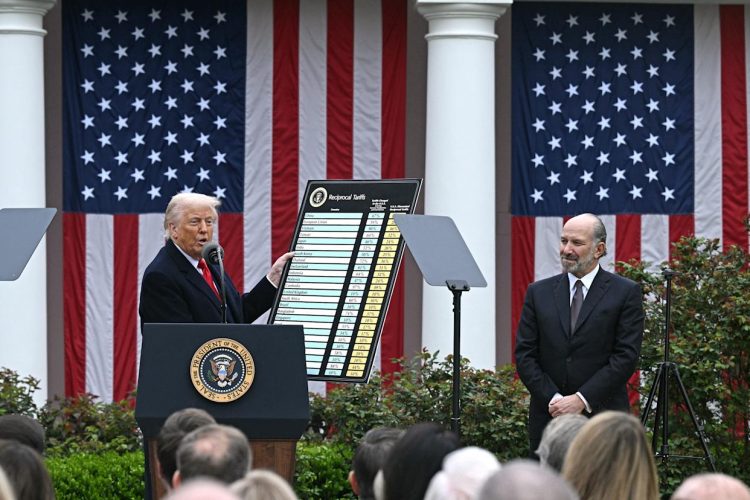

The name Donald-25 derives not only from Trump’s 2025 comeback campaign but also the average projected tariff rate under his proposed plan. While his initial “America First” trade doctrine had already upended global norms, this new version doubles down on unilateralism. Unlike the targeted tariffs of his 2018–2020 presidency, Donald-25 hints at a broad, near-blanket approach—remaking tariff schedules across industries and countries in one fell swoop.

Originating from leaked memos and campaign speeches, the plan proposes tariffs across all imports, regardless of origin, with special emphasis on punishing “unfair trading partners,” namely China. Trump argues that this policy would reduce the trade deficit, encourage domestic manufacturing, and “bring supply chains back home.” However, experts are quick to point out that such a move risks igniting trade wars on multiple fronts, dragging the global economy into a vortex of retaliatory measures and disrupted commerce.

The term has now entered the financial lexicon, much like “Brexit” or “TARP” did in earlier crises, signaling not just a policy but a potential pivot point in global trade history.

The Mechanics of Aggressive Tariff Nationalism

Unlike the intricate and negotiated trade frameworks that characterize traditional economic diplomacy, Donald-25 adopts a blunt instrument approach. By setting universal tariff floors, the policy seeks to weaponize access to the US market—the world’s largest consumer economy—as leverage against foreign competitors. On paper, the idea is simple: make foreign goods more expensive, thereby encouraging American consumers and companies to buy domestically.

But the simplicity ends there. The modern global economy is built on transnational supply chains. From iPhones to EV batteries, parts and components cross borders multiple times before assembly. Blanket tariffs disrupt this finely tuned network. The Donald-25 plan does not discriminate between ally and rival, which means European carmakers, Japanese chip producers, and even Canadian timber exporters would be caught in the same net as Chinese steel firms.

Such a policy framework stands in stark contrast to the multilateral principles enshrined in the World Trade Organization (WTO). It reflects a unilateral stance that views trade less as mutual cooperation and more as zero-sum competition. This framework could significantly realign geopolitical alliances and shift the gravitational center of global trade away from the United States.

Supply Chains Under Siege: Fragility Exposed Again

The COVID-19 pandemic was a rude awakening for global supply chains. So were the semiconductor shortages and container logjams of 2021. Yet, Donald-25 has the potential to be a far more deliberate and sustained stress test. By imposing cost shocks on all imported goods, it threatens to revive the supply chain chaos—but this time from a policy-induced shock rather than a natural or logistical one.

Consider the auto industry. American car manufacturers, though based in the US, rely on components from Canada, Mexico, Germany, and South Korea. A 10% tariff on these parts increases production costs, which are likely to be passed on to consumers. This raises vehicle prices, reduces affordability, and could stall EV adoption just as it is beginning to gain momentum. Small and mid-sized businesses are even more vulnerable, lacking the scale and negotiating power to absorb higher input costs.

Worse still, countries affected by these tariffs would almost certainly retaliate. The European Union has already signaled that it would consider reciprocal tariffs if unfairly targeted. China’s Ministry of Commerce has hinted at a possible reinstatement of soybean and aircraft tariffs. The domino effect could splinter global supply routes, reduce trade volumes, and erode trust in cross-border partnerships.

Rewriting Trade Relationships: From Partners to Rivals

Donald-25 doesn’t just change tariffs—it reshapes relationships. Historically, trade has served as a diplomatic bridge, creating interdependencies that discourage conflict and promote cooperation. Blanket tariffs reintroduce the idea of economic isolationism, even among allies.

For instance, the United States-Mexico-Canada Agreement (USMCA) was intended to replace NAFTA with a more modern framework for North American trade. But under Donald-25, those very partners might find themselves penalized. Similarly, close Asian allies such as South Korea and Japan, key players in semiconductor and defense supply chains, would face economic headwinds if their exports are indiscriminately taxed.

This deterioration of trust risks long-term diplomatic damage. Trade agreements, which typically take years to negotiate, rely on stable policy environments. If the US begins to reverse or undermine agreements through executive fiat, other countries may seek alternative markets and alliances—further accelerating the diversification of global trade away from the US.

China, for its part, stands to gain politically even if it suffers economically. The country has been actively working to position itself as a defender of multilateralism, deepening trade ties through the Regional Comprehensive Economic Partnership (RCEP) and Belt and Road Initiative. If Donald-25 triggers a new US-versus-the-world posture, China could capitalize on global frustration, recasting itself as a more predictable partner in contrast to an increasingly mercurial America.

Looking Back to Look Forward: Echoes of Trade Disruptions Past

To fully grasp the possible consequences of Donald-25, it helps to look at past trade shocks. The Smoot-Hawley Tariff Act of 1930, which raised US tariffs on over 20,000 imported goods, is often cited as a cautionary tale. Though it was introduced with the aim of protecting American jobs during the Great Depression, it instead provoked retaliatory tariffs that reduced international trade by over 65% and deepened the global economic downturn.

More recently, Trump’s first-term tariff wave—particularly on Chinese goods—disrupted supply chains, hurt US farmers, and led to billions in subsidies to offset trade losses. While the immediate political benefits were clear, the long-term costs were significant. Companies like Harley-Davidson and General Motors cited tariffs as reasons for cost hikes, layoffs, or production relocation.

Donald-25 risks magnifying these effects, turning a tactical tool into a strategic doctrine. The global economy is far more integrated today than it was in the 1930s or even the 2010s. A broad, indiscriminate tariff wall could reduce global GDP, inflate prices worldwide, and spur a new era of economic nationalism—one where countries prioritize local production at the expense of efficiency, innovation, and cooperation.

Conclusion: Protection or Provocation?

Donald-25 embodies a pivotal question: Can economic self-interest be secured through isolation, or does the path to national prosperity still lie in global engagement? The answer isn’t clear-cut. Reshoring some strategic industries is arguably prudent in a more fragmented world. But swinging the pendulum too far risks triggering a backlash that could harm the very workers and industries the policy seeks to protect.

The global trade web is a delicate and complex construct—built over decades through negotiation, compromise, and mutual benefit. Unraveling it with a single, sweeping policy like Donald-25 may appeal to political instincts, but it comes with high economic and geopolitical costs.

As the world watches Washington, the decisions made in the coming months may not just define America’s trade policy—they could redraw the entire map of global commerce.