[Rare! More than 480,000 containers waiting for this important port “big jam” at the peak! Global shipping prices soared collectively] On Monday local time, global shipping giant Maersk Group said that due to strong demand in the container market, the chaos caused by the Red Sea crisis continues, and there are signs of further congestion in global ports, especially in Asia and the Middle East.

Global shipping giant Maersk said on Monday there are signs of further congestion at ports around the world, especially in Asia and the Middle East, as the chaos caused by the Red Sea crisis continues due to strong demand in the container market.

Singapore is one of the world’s busiest ports and a major transit hub in Asia, and recent congestion at the port has raised concerns in the industry.

Severe congestion at the Port of Singapore

Singapore is the world’s second largest container port. According to a recent report by Linerlytica, an Asian container consultancy, container ships in Singapore may have to wait up to seven days for a berth, compared to a normal half day. The industry believes that the recent bad weather conditions in Southeast Asia have exacerbated port congestion in the region.

The latest figures show a surge in the number of containers waiting to be docked in Singapore in May, with a peak of 486,600 20-foot standard containers in late May.

According to the Shanghai Securities News, the Maritime and Port Authority of Singapore (MPA) has issued two articles in response to the heated social discussion about Singapore’s port congestion.

In a recent report in response to the media, the MPA said that there are two main reasons for Singapore’s port congestion: shipping delays and a surge in container throughput.

First, the Red Sea crisis caused ships to detour around the Cape of Good Hope in Africa, disrupting the planning of major ports around the world. Many ships were unable to arrive as planned, and when unscheduled ships arrived at ports, there were queues, resulting in a “ship clustering” effect.

Since the beginning of 2024, Singapore has seen a significant increase in ship arrivals. For tankers and bulk carriers, replenishment and refueling activities are carried out within the berthing area and are therefore not affected. But for container ships, due to supply chain disruptions in the upstream region, container volumes have increased significantly in the past few months, and container ships have arrived “bunching”.

The MPA said that in the first four months of 2024, average monthly container ship arrivals reached 72.4 million gross tonnes, an increase of more than one million gross tonnes per month compared to the same period last year. Excluding container ships, the gross tonnage of ships arriving in Singapore, including bulk carriers and tankers, rose 4.5 per cent year-on-year to 1.04 billion gross tonnes in the first four months of 2024.

Regarding the congestion status quo, MPA said that while most container ships berth when they arrive, port operator PSA has worked with liner companies to adjust the arrival schedule when it is feasible, and the average waiting time for container ships is about two to three days when it is not feasible (i.e. the arrival schedule cannot be adjusted).

MPA added that the increased demand for container handling in Singapore is partly due to the fact that some shipping lines have abandoned subsequent voyages in order to catch up with the next schedule, and have concentrated their cargo from Southeast Asian countries in Singapore, which has lengthened the loading and unloading time for ships.

“Other vessels calling in Singapore (about two-thirds of arriving vessels) have not experienced delays in berthing. There is currently no overcrowding at the anchorage.” MPA indicates the value.

Global freight rates soared

According to CCTV finance, in order to ease port congestion, port operator PSA Singapore said that it re-used the old berths and shipyards that had been deactivated at Singapore’s Keppel Terminal, and also increased manpower. Following the new measures, PSA said the number of containers it can handle per week will increase from 770,000 TEUs to 820,000.

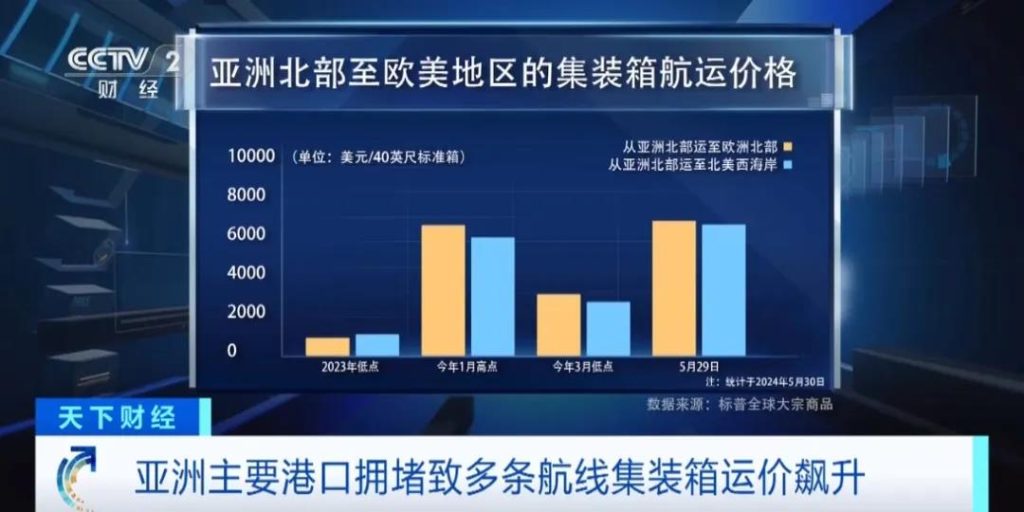

The latest report from S&P Global shows that congestion at major Asian ports, especially Singapore, has also contributed to higher container shipping prices.

As of May 30, Asia-to-Europe freight rates are now $6,200 per 40-foot container, while Asia-to-North America West Coast freight rates have climbed to $6,100.

The global supply chain is facing several uncertainties, including the geopolitical crisis in the Red Sea, the frequent occurrence of extreme weather around the world, which can cause shipping delays, and the risk of strikes. The S&P Global report points to a possible strike by Canadian customs border agents in June, as well as strikes at U.S. East Coast and Gulf Coast ports when contracts expire this fall.

According to the Shanghai Securities News, Shanghai Shipping Exchange released data on June 3, Shanghai export container settlement Freight Index (SCFIS) European routes and US-West routes both rose, and both reached a new high this year:

The European route index was last at 3798.68 points, up 12.8% from last week, and up 72% in the past month (that is, nearly four weeks).

The U.S.-West Route index was last at 3240.51 points, up 5.1% from last week and up 77% in the past month.

Han Jun, chief analyst of Citic Construction Securities transportation, recently issued a report saying that it is necessary to “pay attention to the opportunities of the consolidation industry.” His main points are as follows:

- Reshaping the international order in the context of globalization, with competition and cooperation coexisting. The world has gradually entered an era of de-dollarization, and resource goods such as commodities have begun to act as the general equivalent of the era of credit money.

- The process of China’s manufacturing industry going to sea is gradually shifting from the global super factory to the global distributed factory. The transportation changed from linear transportation to curved transportation, increasing the transportation of a large number of intermediate goods and lengthening the shipping distance.

- The reversal of global growth momentum could be the beginning of a new era. Instead of being a drag on global growth, Europe and the United States must now shift to an analytical framework with emerging economies as the core variable.

- Be alert to upside risks in resource goods and shipping industry. Supply chain restructuring is a trend variable, while the Red Sea crisis is a pulse variable. It is recommended to pay attention to the bulk transportation industry.