It’s so sudden! Plummeting $440 billion! Analysts downgrade Nvidia to ‘neutral’

On the US stock market on Friday local time, although the three major indexes rose collectively, Nvidia’s share price suddenly plunged in the late afternoon, and as of the close of trading, the share price fell nearly 2%, and the total market value of $60.3 billion (about 440 billion yuan) was wiped out in a single day. On the same day, Pierre Ferragu, an analyst at New Street Research, a market researcher, issued a warning on Nvidia’s stock and downgraded Nvidia to “neutral.”

According to the latest disclosure documents of the United States Securities and Exchange Commission (SEC), Nvidia CEO Huang Renxun sold 240,000 shares of Nvidia common stock on July 2 and 3 at an average price of $123.2567 per share, worth about $29.5816 million.

Meanwhile, Nvidia is facing a regulatory storm in the European market. Margrethe Vestager, the European Commission’s executive vice president and competition commissioner, warned of a “huge bottleneck” in the supply of Nvidia’s AI chips. Eu regulators are considering whether and what action to take.

Be hit by an air raid

The hot global chip giant – Nvidia, recently suddenly suffered a fierce “air attack”.

On Friday, local time in the United States, Nvidia shares suddenly plunged in the late afternoon, and as of the close of trading, the stock price fell nearly 2%, and the total market value of $60.3 billion in a day.

On July 5, Pierre Ferragu, an analyst at New Street Research, issued a warning on Nvidia stock and downgraded Nvidia to “neutral.”

He believes Nvidia’s stock has limited upside except in a bull market. After rising 240% last year and 157% this year, Nvidia’s stock price has fully reflected the valuation.

“While Nvidia remains the strongest franchise in the AI data center space, near-term expectations and valuations justify a more cautious view on the stock,” Pierre Ferragu wrote in the report.

Pierre Ferragu said revenue models suggest Nvidia’s growth rate will slow to a moderate level, with revenue from graphics processing units (Gpus) expected to grow only 35 percent next year.

Based on Nvidia’s 2019 and early 2020 earnings multiple (35 times), he has a price target of $135, which is 5% higher than Wednesday’s closing price.

Ferragu further said that Nvidia’s P/E ratio could fall as the stock trades at 40 times expected earnings over the next 12 months, compared to 20 times in 2019 when growth slowed to 10 percent.

Still, he believes the company’s fundamental quality remains intact and would only consider buying again if Nvidia’s stock price continues to suffer.

It is worth mentioning that there are very few analysts on Wall Street who have negative views on Nvidia at present. Before that, only Germany’s DZ bank downgraded Nvidia from “buy” to “hold” in May.

According to TipRanks.com, 38 of 41 analysts recommend buying Nvidia shares, three recommend holding them and none recommend selling them.

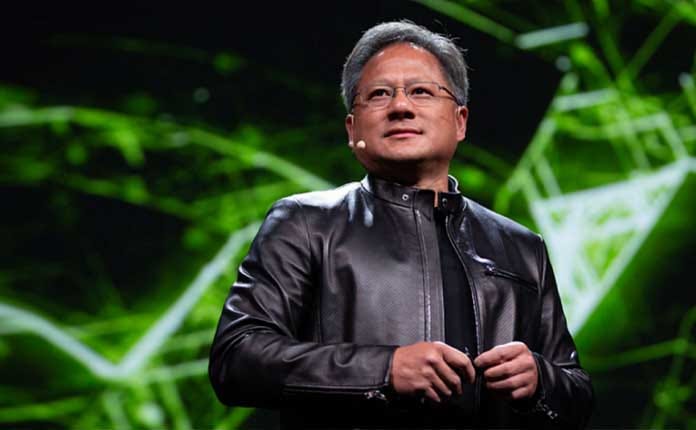

Thanks to the launch of ChatGPT at the end of 2022, which triggered a boom in artificial intelligence (AI) technology, Nvidia is highly sought after for funding. But in recent weeks, Nvidia’s shares have fallen back as some investors, including founder and CEO Jen-Hsun Huang, have opted to lock in profits.

According to an SEC filing on Friday, Huang sold 240,000 shares of Nvidia common stock on July 2 and 3 at an average price of $123.2567 per share, valued at about $29.5816 million.

Regulatory storm

Meanwhile, Nvidia is facing a regulatory storm in the European market.

Margrethe Vestager, the European Commission’s executive vice president and competition commissioner, warned of a “huge bottleneck” in the supply of Nvidia’s AI chips.

Vestager said that EU regulators were considering whether and what action to take, “we have been asking them questions, but this is still a preliminary step, so far this does not count as regulatory action.”

According to Vestager’s social media accounts, she visited Singapore for three days to participate in a conference organized by the National Artificial Intelligence Core (AI Singapore) to discuss how to elevate AI projects and accelerate the process from research to deployment, and from modeling problems to solutions.

Vestager mentioned that AI chips face tight supply, and the secondary market could help spur innovation and level the playing field. But she noted that dominant companies may face certain behavioral restrictions in the future.

Vestager warned, “If you have that kind of dominance in the market, there are things that small companies can do that you’re not allowed to do.” But as long as you focus on your business and respect that, there shouldn’t be any problems.”

At present, Nvidia’s GPU has become the hottest commodity in the technology industry, attracting many technology giants to throw a lot of money to grab. Nvidia’s flagship product, the H100, is estimated to have helped the company gain more than 80 percent market share, significantly ahead of its main competitors Intel and AMD.

Earlier this week, news broke that French regulators would file an antitrust case against Nvidia, which would be the first law enforcement agency in the world to take antitrust action against the company.

France plans to launch an antitrust case against Nvidia, accusing it of exploiting its market dominance and expressing concern about the AI industry’s deep reliance on CUDA programming tools. Under French antitrust rules, companies that violate antitrust laws can face fines of up to 10 percent of their annual global turnover, though companies can also make concessions to avoid fines.

In November last year, Bruno Le Maire, France’s Minister of Economy, Finance and Industry, Digital Sovereignty, said that Nvidia’s dominance in the AI chip market has increased international inequality and suppressed market competition, and data shows that 92% of the GPU market is occupied by Nvidia.

The European Commission has also been informally gathering comments to determine whether Nvidia may also have violated EU antitrust rules, but it has not opened a formal investigation into monopolistic practices.

Analysts say the EU’s antitrust move reflects concerns about the dominance of U.S. tech giants in new technologies. European companies have long spent less on investment and research and development, causing their growth rate to lag behind that of the United States.