1. A Fragmented Financial World

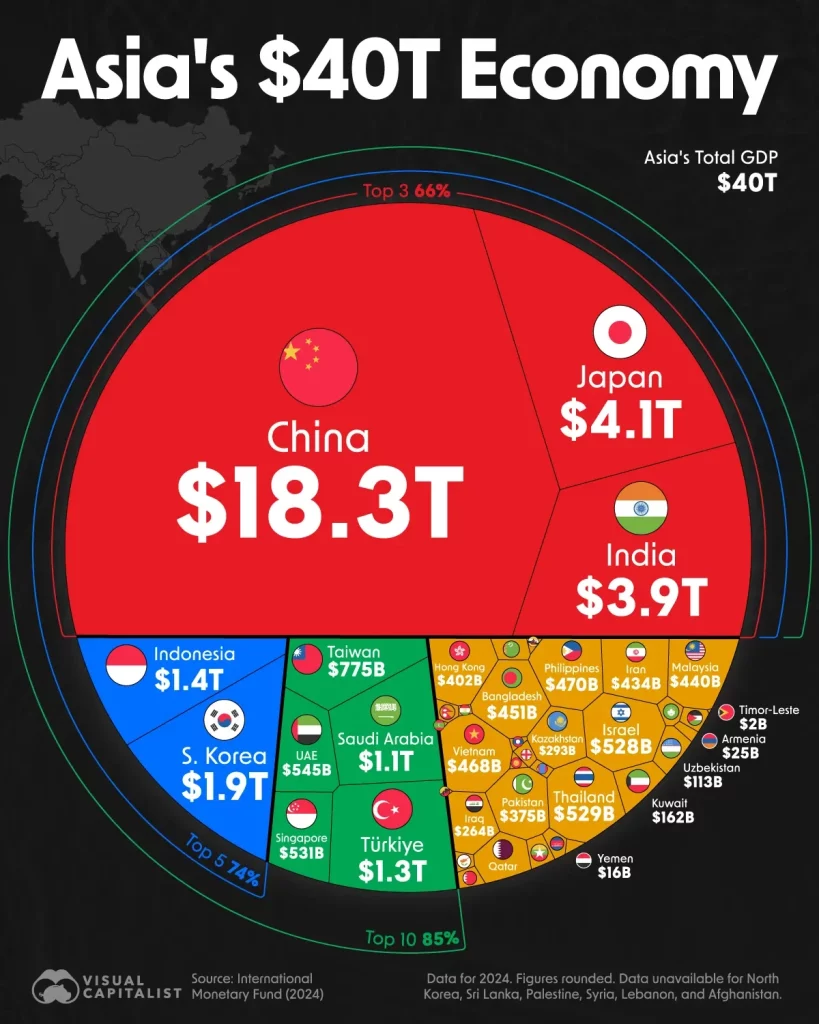

As 2025 unfolds, Asia stands at the center of a shifting financial order—one defined as much by fragmentation as by integration.

The post-Cold-War assumption of a globalized financial system—built on open markets, shared rules, and the U.S. dollar’s dominance—is being quietly rewritten.

The twin forces of geopolitical tension and regulatory realignment are redrawing Asia’s economic map. From sanctions and supply-chain de-risking to digital currencies and capital controls, Asia’s financial systems are adapting to a world that is no longer flat, but layered, regionalized, and competitive.

In this new environment, integration no longer means uniformity. It means building bridges that can withstand political shocks—linkages that balance openness with resilience.

2. The Regulatory Pendulum Swings

Financial regulation across Asia in 2025 has turned decisively toward stability, transparency, and sovereignty.

In the wake of the 2020s’ volatile decade—marked by pandemic stimulus, crypto booms, and global banking stress—Asian regulators have sought to tighten oversight and localize financial risk management.

- China has advanced a “dual-circulation” financial model, emphasizing domestic capital formation and yuan-based settlement systems. The People’s Bank of China (PBoC) has deepened digital currency (e-CNY) pilots, integrating them into cross-border payment frameworks like the mBridge project with Hong Kong, Thailand, and the UAE.

- Japan and Singapore are moving toward “proportionate regulation,” balancing innovation with risk controls for fintech and crypto assets.

- India has formalized a new financial data architecture—the “Account Aggregator Framework”—giving individuals control over data while improving credit transparency.

- Across ASEAN, regulators are harmonizing capital standards under Basel IV and establishing digital asset guidelines to prevent contagion from speculative platforms.

The result is a more cautious, layered regulatory environment: one that seeks to protect financial systems from shocks—both economic and geopolitical—without choking growth.

3. Geopolitics as Financial Strategy

In 2025, geopolitics and finance are inseparable. Every major trade dispute or military flashpoint now has a financial counterpart—from asset freezes and export controls to investment bans and currency realignments.

For Asia, this has created both risk and opportunity.

- The U.S.–China rivalry continues to shape regional capital flows. Washington’s outbound investment restrictions on Chinese AI, semiconductor, and quantum sectors have accelerated the creation of alternative funding ecosystems—private equity pools in Hong Kong, Singapore, and Dubai that cater to “neutral” capital.

- China is deepening its financial links with the Global South through the BRICS New Development Bank (NDB) and bilateral currency swap lines, promoting the renminbi as a partial hedge against dollar dependency.

- ASEAN nations, while benefiting from U.S. and Japanese investment, are hedging strategically—maintaining open access to both Western and Chinese capital.

- Meanwhile, Russia’s pivot to Asia has increased non-dollar commodity trade settlements with India and China, further testing the boundaries of the dollar-centric system.

This landscape is one of competitive integration—where multiple financial spheres coexist, overlap, and occasionally collide.

4. The Rise of “Financial Regionalism”

The idea of a unified global financial system is fading; what is emerging instead is financial regionalism.

Asia is now home to at least four overlapping financial architectures:

- U.S.-aligned markets, anchored by Japan, Korea, and Taiwan.

- China-centric networks, including the Belt and Road Initiative (BRI), BRICS+, and yuan settlement systems.

- ASEAN financial corridors, built on multilateral cooperation like the Chiang Mai Initiative and the ASEAN Banking Integration Framework (ABIF).

- Hybrid hubs—Singapore, Hong Kong, and Dubai—that mediate capital between competing blocs.

This patchwork is both a response to and a buffer against global uncertainty.

By diversifying their financial relationships, Asian economies hope to achieve strategic autonomy—the ability to operate amid great-power rivalry without being forced into binary choices.

5. The Digital Finance Frontier

Beyond geopolitics, a silent revolution is transforming Asia’s financial infrastructure: digital integration.

The region is now a test bed for next-generation payment and settlement systems.

- Cross-border instant payments between ASEAN members are being piloted through Project Nexus, connecting real-time payment networks across Singapore, Malaysia, Indonesia, and Thailand.

- Central Bank Digital Currencies (CBDCs) are entering live deployment stages—China’s e-CNY, India’s e-Rupee, and Japan’s digital yen experiments are redefining how money moves.

- Blockchain-based trade finance platforms are being adopted in Hong Kong and Singapore to reduce fraud and improve transparency.

Digital finance is not merely a technological upgrade—it is a strategic response to fragmentation. By building digital rails that bypass traditional correspondent banking networks, Asian economies are effectively de-risking globalization—maintaining cross-border liquidity without full reliance on Western systems like SWIFT.

6. Green and Sustainable Finance: A Quiet Revolution

While geopolitics dominates headlines, sustainable finance has quietly become a unifying theme across Asia.

Green bonds, ESG disclosure standards, and carbon-credit markets are expanding rapidly.

- Singapore is positioning itself as Asia’s green finance capital, hosting regional carbon exchanges and mandating ESG reporting for listed firms.

- China’s green bond issuance surged again in 2025, with domestic taxonomies now partially aligned with EU standards.

- Japan and Korea are leveraging their industrial bases to finance renewable energy supply chains and hydrogen projects across Southeast Asia.

However, the challenge lies in standardization. With multiple ESG taxonomies—Chinese, EU, ASEAN—the lack of harmonization risks fragmenting the very market meant to unify sustainability efforts.

Still, the long-term trajectory is clear: green finance is not a niche trend but the next pillar of Asia’s economic integration.

7. The Shadow of Risk: Sanctions, Cyber, and Fragmentation

Yet even as Asia builds new frameworks, the region’s financial systems face a widening array of risks.

- Sanctions exposure: Multinational banks in Singapore and Hong Kong must navigate complex compliance regimes as U.S. and EU sanctions expand to cover dual-use technologies and supply chains.

- Cybersecurity threats: The digitization of finance brings systemic vulnerabilities. The Monetary Authority of Singapore (MAS) and Bank of Japan have launched regional cybersecurity drills, acknowledging that a single major breach could disrupt payment systems.

- Fragmented standards: Diverging rules on digital assets, data privacy, and ESG reporting create friction for cross-border investors.

In essence, the more Asia integrates digitally and financially, the greater its exposure to cross-system shocks. The challenge is not whether integration should happen—but how safely it can occur.

8. Toward an “Asian Financial Order”?

Is Asia moving toward its own financial order? The answer, cautiously, is yes—but not in the traditional sense.

Rather than replicating Western institutions, Asia is building a networked order—a system of interdependent yet autonomous nodes.

Shanghai, Singapore, and Tokyo are no longer competing solely for dominance; they are evolving into complementary hubs linked by technology, liquidity, and talent flows.

Multilateral cooperation—through BRICS+, ASEAN+, and APEC—is increasingly financial in nature, focusing on payment connectivity, regulatory dialogue, and local-currency settlements.

The renminbi’s share in Asia’s trade settlement has quietly risen above 20%, though the dollar remains dominant for reserves and commodities.

The emerging vision is one of plural financial sovereignty—a recognition that no single model can or should define Asia’s financial future.

9. The Integration Paradox

Ironically, as Asia becomes more financially connected, it also becomes more politically fragmented.

Each country’s regulatory reform is guided less by global consensus and more by national security economics—the idea that finance is now part of strategic defense.

For investors and corporations, this creates a paradox:

- Integration increases efficiency and opportunity.

- But fragmentation increases compliance complexity and risk premiums.

Managing this dual reality will define Asian finance in the next decade. The winners will be those institutions agile enough to operate across multiple regulatory realities, while maintaining transparency, compliance, and digital readiness.

10. Conclusion: Navigating the New Order

The future of Asian finance will not be written in Washington or Brussels—it will be shaped in Beijing, Tokyo, Singapore, and Mumbai.

Asia’s challenge in 2025 is to build financial systems that are open enough to attract global capital, but insulated enough to withstand global shocks.

That means stronger regional safety nets, smarter regulation, and digital infrastructure that balances innovation with trust.

If successful, the region could pioneer a new model of integration—one that is multipolar, pragmatic, and resilient.

In a world where finance and geopolitics are inseparable, Asia’s quiet experiment in hybrid integration may well define the contours of the next global order.