1. Introduction: A Decade of Digital Disruption

The financial map of Asia in 2025 looks vastly different from a decade ago.

Where once traditional banks and global capital dictated the rhythm of credit and payments, the region is now powered by algorithms, mobile wallets, digital currencies, and decentralized finance platforms.

From the bustling fintech corridors of Singapore and Hong Kong to the digital-payment ecosystems of India and Indonesia, Asia has become the epicenter of financial innovation.

This revolution is not confined to startups or venture capital; it has permeated central banks, sovereign funds, and retail investors alike.

In a world where trust, efficiency, and inclusion are paramount, Asia is quietly building the blueprint for the next financial order — one that is faster, more open, and less dependent on Western financial infrastructure.

2. The Post-Pandemic Acceleration

The COVID-19 pandemic was the great catalyst for fintech adoption in Asia.

Between 2020 and 2023, digital payments across Asia-Pacific grew by more than 40%, while online lending and neobanking doubled their user base.

Governments played an unexpectedly proactive role.

Singapore’s Monetary Authority (MAS) fast-tracked digital-bank licenses; India scaled its Unified Payments Interface (UPI) into the backbone of its digital economy; and China’s e-CNY (digital yuan) pilot expanded into 26 cities, integrating seamlessly with public transport, retail, and cross-border payment scenarios.

By 2025, these experiments have coalesced into a regional movement: fintech is no longer a niche sector but an essential pillar of financial and economic infrastructure.

Where the U.S. and Europe grapple with fragmented regulation and slow adoption, Asia is synchronizing innovation with policy direction — a rare alignment that magnifies both its speed and impact.

3. The Rise of Digital Payments

No trend embodies Asia’s fintech rise more clearly than digital payments.

Asia now processes more than 60% of the world’s mobile payment transactions, according to a 2025 report by the BIS (Bank for International Settlements).

- China: The Alipay–WeChat Pay duopoly continues to dominate, but the focus has shifted from growth to integration. These platforms now plug into the central bank’s digital currency infrastructure, allowing instant cross-border settlements between mainland China and Hong Kong.

- India: UPI handles over 14 billion transactions per month, extending to Nepal, Bhutan, and the UAE. Its open-source architecture has inspired similar frameworks across ASEAN.

- Southeast Asia: Platforms such as GrabPay, GoPay, and Dana are unifying fragmented markets under the ASEAN Payment Connectivity Initiative, enabling wallet-to-wallet transfers across borders in real time.

This payment revolution is more than convenience — it is financial democratization.

For the first time, millions of micro-merchants and rural consumers are participating in formal finance, building data footprints that fuel credit scoring and small-business lending.

4. Digital Banks and the Race for Financial Inclusion

In 2025, the digital banking revolution is in full stride.

Asia leads the world with over 80 fully licensed digital banks, operating in markets ranging from South Korea to the Philippines.

The competitive logic is straightforward:

- High smartphone penetration

- Low traditional banking access

- Regulators open to experimentation

Singapore’s digital-bank license framework has become a model for balancing innovation with stability.

In South Korea, digital banks such as KakaoBank and Toss Bank now command over 20% of retail deposit market share.

In Indonesia and the Philippines, partnerships between fintech startups and established conglomerates — such as SeaBank and Tonik — are bridging the gap between tech agility and financial credibility.

The implications are transformative.

Where traditional banks once saw underserved populations as unprofitable, digital banks view them as data-rich ecosystems.

Credit algorithms trained on mobile payment histories and social signals are unlocking entirely new layers of economic participation.

The result is not merely inclusion — it is redefinition: banking without branches, savings without intermediaries, and trust built on code, not paperwork.

5. The Digital Currency Experiment

Central Bank Digital Currencies (CBDCs) represent Asia’s most ambitious fintech frontier.

While Western economies debate theoretical risks, Asia is already deploying.

- China’s e-CNY leads the global race. Its pilot network now processes millions of daily transactions and is being linked to Hong Kong’s FPS (Faster Payment System).

- India’s Digital Rupee is being integrated into government disbursements, ensuring transparency in welfare transfers.

- Japan, South Korea, and Singapore are experimenting with wholesale CBDCs, focusing on interbank settlements and cross-border transactions.

The mBridge project — a collaboration between the central banks of China, Thailand, Hong Kong, and the UAE — has proven that instant multi-currency settlement across borders is not only feasible but efficient.

Transaction times that once took two days now take seconds, and costs have fallen by over 70%.

These initiatives are not merely technical upgrades; they represent a geopolitical realignment.

Asia is building its own parallel settlement rails — resilient to sanctions, independent of SWIFT, and aligned with regional growth patterns.

In a de-globalizing world, this may be one of the most consequential financial transformations of the decade.

6. Blockchain, Tokenization, and Capital Market Reinvention

Beyond payments and banking, blockchain and tokenization are transforming Asia’s capital markets.

In 2025, several key experiments have matured into functioning systems:

- Hong Kong launched its first government-backed tokenized green bond, raising $750 million with real-time investor settlement.

- Singapore’s Project Guardian, a multi-bank initiative led by MAS, has expanded tokenized asset trading into bonds, funds, and carbon credits.

- Japan’s SBI and Nomura have established regulated digital-asset exchanges for institutional investors.

Tokenization is doing for capital markets what mobile wallets did for payments — lowering entry barriers and increasing liquidity.

Fractional ownership models allow investors from Manila to Mumbai to buy slices of infrastructure projects, renewable farms, or art collections with minimal capital.

Critically, this innovation is happening under regulatory supervision, not in the shadow of speculation.

By fusing blockchain transparency with financial governance, Asia is demonstrating how digital finance can evolve responsibly.

7. Venture Capital and the Fintech Investment Cycle

After a period of exuberance in 2021–2022, fintech valuations cooled in 2023.

But by mid-2025, a second wave of disciplined capital has arrived.

Venture investors now favor profitability and scalability over user growth.

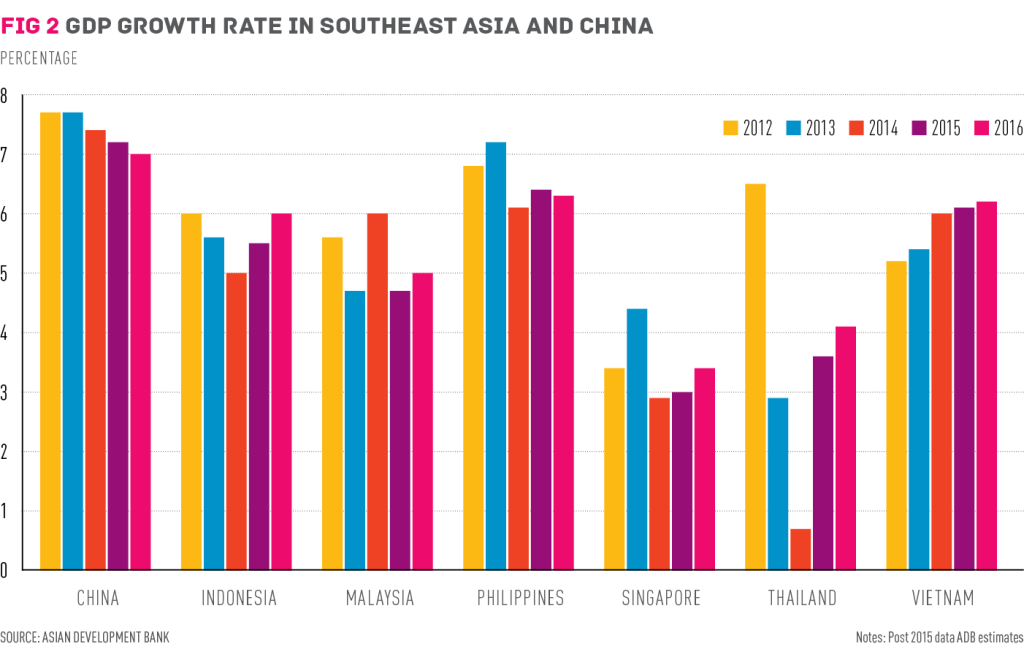

India, Indonesia, and Vietnam have become the top destinations for fintech funding, collectively attracting over US$18 billion in 2024.

Meanwhile, sovereign funds like Temasek, GIC, and Khazanah are doubling down on late-stage investments in payments, cybersecurity, and AI-driven credit analytics.

Unlike the “move fast and break things” ethos of Silicon Valley, Asia’s fintech model emphasizes regulatory partnership and long-term infrastructure.

Governments often act not as obstacles but as co-designers — aligning innovation with national strategies for inclusion, sustainability, and digital sovereignty.

8. Risks and Regulation: The Balancing Act

The surge of fintech innovation has forced regulators into a delicate balancing act.

The risks are manifold:

- Data privacy and cybersecurity breaches threaten public trust.

- Shadow lending and unregulated buy-now-pay-later schemes could destabilize household finances.

- Crypto-asset volatility continues to challenge monetary stability.

Yet Asian regulators, drawing lessons from early turbulence, are ahead of the curve.

The Financial Services Agency of Japan and Monetary Authority of Singapore have developed sandbox frameworks to test new models safely.

India’s Reserve Bank enforces interoperability across platforms to prevent monopolies.

China’s regulators, after tightening crypto speculation, now selectively endorse blockchain use for supply-chain finance and cross-border trade.

The unspoken consensus: innovation is inevitable, but regulation must move in tandem, not in hindsight.

Asia’s success so far lies not in avoiding risk, but in governing experimentation.

9. Financial Inclusion and the Human Dividend

Beyond capital and technology lies the human story.

Fintech in Asia is rewriting the social contract of finance.

From smallholder farmers in Indonesia using mobile credit to women entrepreneurs in India securing loans through digital platforms, the region’s fintech wave is lifting millions out of financial invisibility.

Remittances — once dominated by expensive intermediaries — now flow instantly through blockchain-enabled corridors between Southeast Asia, the Gulf, and South Asia.

In countries like Bangladesh and Cambodia, where formal banking access was below 25% a decade ago, mobile-based financial inclusion has surged past 70%.

The dividends are tangible: higher savings rates, greater entrepreneurship, and stronger community resilience.

10. Outlook: Asia’s Blueprint for Global Digital Finance

As 2025 enters its final quarter, Asia’s fintech experiment is no longer an outlier — it’s a prototype for the future of global finance.

The region has achieved what many thought impossible: scale, inclusion, and innovation without systemic collapse.

The next frontier will be interoperability — connecting Asia’s diverse digital systems into a cohesive financial web.

Projects like the BIS-supported Nexus initiative and ASEAN’s real-time cross-border settlement frameworks are early glimpses of a pan-Asian digital financial grid.

Ultimately, the lesson from Asia’s fintech renaissance is that technology alone does not drive progress.

It is the combination of innovation, regulation, and purpose — the recognition that finance is a tool for empowerment, not exclusion — that defines success.

In the words of one Singaporean policymaker:

“We’re not just digitizing money. We’re redesigning trust.”

And as the world watches, Asia’s digital trust may become its most valuable export.