Introduction

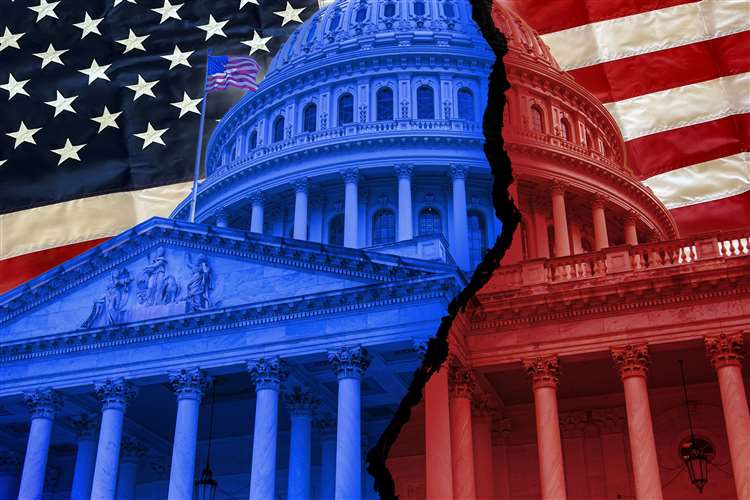

American politics has always held significant influence over the global financial landscape, from stock markets to currency fluctuations, economic policy shifts, and beyond. In recent years, however, the changing nature of American politics—marked by polarization, volatility, and unexpected policy shifts—has begun to have a deeper and more profound impact on both domestic and international financial markets. Understanding these changes and how they affect investor decision-making is key to navigating the increasingly complex financial landscape of the U.S.

As the political climate shifts, so too does investor sentiment, leading to market uncertainty, changes in economic policy, and new risks and opportunities. This article aims to explore how changes in American politics affect both domestic and international financial markets, the implications of political turmoil for investor decision-making, and how investors can adjust their strategies in response to shifts in U.S. political stability.

How Changes in American Politics Affect Domestic and International Financial Markets

The influence of American politics on financial markets cannot be overstated. The U.S. is home to the world’s largest economy, and its financial markets—comprising the stock market, bond market, and foreign exchange markets—are some of the most important in the global economy. When American political dynamics shift, they send ripple effects throughout the world.

Domestic Financial Markets

Internally, shifts in the political landscape can lead to changes in market behavior. For instance, during presidential elections, political parties with different economic agendas often have an impact on market predictions. Pro-business candidates might spur optimism, causing a rise in stocks, while candidates with more progressive agendas might cause concern about regulation and tax increases, leading to a market sell-off. The uncertainty surrounding the outcome of contentious elections can also lead to market volatility.

In particular, the U.S. stock market often reacts to the potential of policy changes that could either incentivize or constrain economic growth. For example, the 2016 election of Donald Trump, with promises of deregulation and tax cuts, was followed by an immediate surge in the stock market, especially in sectors like energy, healthcare, and finance. On the other hand, the Biden administration’s emphasis on regulation, climate change policies, and raising corporate taxes has triggered a shift in market sentiment, with certain sectors seeing a decline while others, such as renewable energy, have risen.

Moreover, political uncertainty—whether in the form of unexpected election results, impeachments, or government shutdowns—can create risk in financial markets. Investors tend to pull back when there is instability, as political risk is seen as an additional layer of uncertainty on top of economic factors. Consequently, stocks may become more volatile, and safe-haven assets such as gold or bonds may see increased demand.

International Financial Markets

The effects of U.S. political changes extend far beyond national borders. As the world’s largest consumer market and a key player in global trade, any shift in U.S. political policies—whether related to tariffs, trade agreements, or foreign diplomacy—can influence financial markets worldwide. For instance, the trade war between the U.S. and China during the Trump administration had widespread effects on global supply chains, trade flows, and market sentiment, causing significant volatility in global stock markets.

Similarly, changes in U.S. foreign policy can cause ripple effects in international financial markets. Political decisions regarding defense spending, sanctions, and foreign trade agreements can either boost or hinder the performance of certain global markets. Additionally, global currency markets are highly sensitive to U.S. policy decisions. The strength of the U.S. dollar, for example, is often tied to decisions made in Washington, D.C. A shift toward protectionist policies or the imposition of tariffs can impact the strength of the dollar and other currencies, leading to changes in foreign exchange rates.

How Political Turmoil in the U.S. Influences Investor Decision-Making

Political turmoil in the U.S.—from impeachment proceedings to contentious elections to legislative gridlock—can create uncertainty for investors. When political stability is in question, investors tend to err on the side of caution, leading to more volatile market conditions.

Uncertainty and Market Volatility

One of the most significant effects of political turmoil is heightened uncertainty. Uncertainty often leads investors to question the stability of the economic system, which in turn may cause them to pull back on riskier investments or delay decisions. A chaotic political environment, where government functions are disrupted or elections are contested, may cause market fluctuations. This is particularly evident in the months leading up to elections, where market volatility often spikes as investors try to anticipate the outcome of the race and the potential economic implications of different candidates’ policies.

For instance, the uncertainty surrounding the 2020 U.S. presidential election, combined with the economic fallout from the COVID-19 pandemic, caused significant swings in global markets. As the election narrowed down to Joe Biden and Donald Trump, investors faced the challenge of predicting which candidate’s policies would prevail, and how the stock market might react to those changes. Political tension between the parties heightened further when the results were contested, leading to additional market instability.

Impact on Risk Appetite

Political turmoil can also have a direct effect on an investor’s risk appetite. When political instability increases, investors often reduce exposure to riskier assets, such as stocks in emerging markets, high-yield bonds, or commodities. Instead, they may seek the safety of more stable assets, such as government bonds, precious metals, or cash.

A case in point is the political unrest surrounding the U.S. government shutdowns in recent years. During these times, markets tend to take a pessimistic view of the economy’s short-term prospects, leading to a shift away from riskier assets to safer alternatives. The reaction of investors to political uncertainty, therefore, can have a profound effect on market liquidity, asset prices, and overall economic sentiment.

How Investors Can Navigate the Shifts in U.S. Political Stability

Navigating shifts in political stability requires a blend of strategy, foresight, and a solid understanding of how politics impacts financial markets. While political turmoil and instability can pose challenges for investors, there are also opportunities for those who can stay ahead of the curve.

Diversification

The first strategy investors can adopt is diversification. Diversifying an investment portfolio across various asset classes, sectors, and geographical regions can mitigate the risks associated with political instability in the U.S. By spreading investments, investors are less likely to be severely impacted by political events in the U.S., especially in times of heightened uncertainty.

For instance, global diversification can provide exposure to markets and sectors that are less affected by U.S. political changes. Similarly, diversifying across different asset classes, such as stocks, bonds, and commodities, can reduce the overall risk in the portfolio.

Focus on Long-Term Trends

Another important strategy is to focus on long-term trends rather than short-term political disruptions. Political turmoil may cause short-term market volatility, but it does not always affect the long-term growth prospects of the economy. Investors who maintain a long-term perspective can ride out periods of uncertainty and capitalize on the eventual return of market stability.

For example, despite short-term fluctuations, markets generally tend to bounce back after periods of political instability. By focusing on sectors with strong long-term growth prospects—such as technology, healthcare, or renewable energy—investors can shield themselves from the impact of temporary political turmoil.

Hedging Political Risk

Another way investors can navigate political instability is through hedging. Using financial instruments such as options, futures contracts, or currency hedging can help mitigate the risks posed by political events. By employing hedging strategies, investors can protect their portfolios from sharp declines in market prices due to political upheaval.

Additionally, some investors may consider alternative investments, such as real estate or commodities, which are less correlated with political events in the U.S. These assets often provide a hedge against the volatility created by political instability in the stock and bond markets.

Conclusion

The changing face of American politics has significant implications for both domestic and international financial markets. Political instability in the U.S. can lead to uncertainty, increased market volatility, and shifts in investor behavior. However, by understanding the dynamics of U.S. politics and their effects on financial markets, investors can make informed decisions, adjust their portfolios, and navigate the complexities of the modern financial landscape. In an era of heightened political turbulence, staying ahead of potential risks and opportunities is essential for successful investing.